Air freight volumes improve for second month in row -India, Korea and China tops for A-P region, says ACI

- News Feed

- Tuesday, 29 November 2016

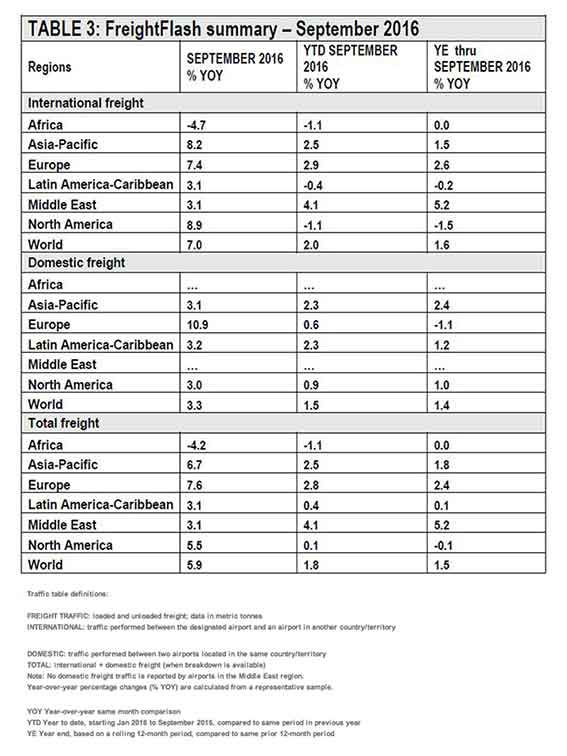

IN September and for the second consecutive month, air freight markets witnessed strong growth - of 5.9 per cent – due mainly to a strengthening of the international freight market (+7 per cent) and the surge in demand for electronic devices exported from Asia, according to the latest Airports Council International (ACI) figures.

Domestic freight volumes grew 3.3 per cent during the same period. Accumulated air freight volumes have inched up 1.8 per cent since the beginning of the year.

Similar to passenger traffic, all regions saw gains in air freight traffic for September except Africa, which recorded a loss of 4.2 per cent. Europe had the highest growth (+7.6 per cent) followed by Asia Pacific and North America with robust increases of 6.7 and 5.5 per cent respectively. Both regions of Latin America-Caribbean and the Middle East experienced 3.1 per cent growth. Out of the top 20 air freight hubs, 15 airports reported growth rates of more than five per cent and only two experienced slight losses. Because air freight is highly concentrated, with the top 20 air freight hubs occupying almost half of global air freight volumes, the strong growth among the major airports increased the global growth figure. While the increase in volumes is cause for optimism, it is still too early to identify a sustained recovery. In alphabetical order:

Africa

In Africa, significant air freight losses were recorded at major commercial airports in Kenya (-10.6 per cent or -2,460 tonnes) and South Africa (-7.9 per cent or -2,310 tonnes). The two major air freight hubs of the region—Nairobi (NBO) and Johannesburg (JNB)—lost 7.7 per cent (-1,630 tonnes) and 10.3 per cent (-2,830 tonnes) of air freight by volume year-over-year. Cairo (CAI) is recovering, with six per cent growth in air freight volumes compared to the previous year (+1,270 tonnes).

Asia Pacific

In the Asia-Pacific region, India, Korea and China were the main contributors to September’s growth (9.3, 7.2 and 6.7 per cent respectively). The top three airports with the highest volume increases were Hong-Kong (HKG, +7.2 per cent or +26,000 tonnes), Shanghai - Pudong (PVG, +7.4 per cent or +20,000 tonnes) and Seoul-Incheon (ICN, +8.1 per cent or +17,000 tonnes). The surge in volumes coincided with the release and replacement of mobile devices including the Galaxy Note 7 and iPhone 7.

Europe

In Europe, all major freight hubs showed an increase in air freight activity. Germany, France and the United Kingdom - the three largest air freight markets in the region - witnessed 6.6, 5.1 and 6.7 per cent growth respectively in September. However, the main drivers for the high regional freight movement were the double-digit growth rates observed at major commercial airports in Turkey, Italy, Spain, Luxembourg, Russian Federation and Switzerland (19, 10.8, 13.5, 14.1, 20.9 and 14.2 per cent respectively). Istanbul-Atatürk (IST) posted the strongest air freight volume growth of 11,500 tonnes (+17.7 per cent), followed by Sheremetyevo (SVO, +129.5 per cent or +10,000 tonnes) that had been recovering from extremely low freight activity. Significant growth was also observed at Frankfurt (FRA, +6.2 per cent or +10,000 tonnes), Paris-Charles de Gaulle (CDG, +5.2 per cent or +8,600 tonnes) and Luxembourg (LUX, +14.1 per cent or +8,300 tonnes).

Latin America-Caribbean

The three largest air freight markets of the region - Colombia, Mexico and Brazil - showed mixed results. While Colombia plunged into negative territory at -0.7 per cent (-550 tonnes), Mexico grew by a strong 10.8 per cent rate (+6,640 tonnes) and Brazil started to show signs of recovery (-2.4 per cent or + 1,500 tonnes) at its major commercial airports. At the individual airport level, the highest growth in absolute terms was registered at Mexico City (MEX, +12.8 per cent or +4,650 tonnes) and Santiago (SCL, +13.8 per cent or + 3,190 tonnes).

Middle East

The two dynamic air freight markets of the region - United Arab Emirates and Qatar - reported mixed results. While six commercial airports in the UAE reported a loss of 2.7 per cent (-9,970 tonnes) in air freight volumes compared to the previous year, Doha (DOH) grew 16.3 per cent (+20,360 tonnes). Strong growth was also recorded in Israel (+24.8 per cent or + 5,130 tonnes) and Oman (+19.8 per cent or +2,165 tonnes).

North America

The major drivers of North American traffic were Chicago-O’Hare (ORD, +16 per cent or +22,500 tonnes), Anchorage (ANC, +5.6 per cent or +11,700 tonnes) and Los Angeles (LAX, +5.9 per cent or +9,000 tonnes). Memphis (MEM, -0.8 per cent or -3,070 tonnes) and Louisville (SDF, +4.6 per cent or +8,930 tonnes) showed mixed results.