GLOBAL freight reached a three-month peak during August, with a 10.5 per cent global increase bringing the year to date growth to 8.7 per cent, according to the latest Airports Council International data.

Freight volumes

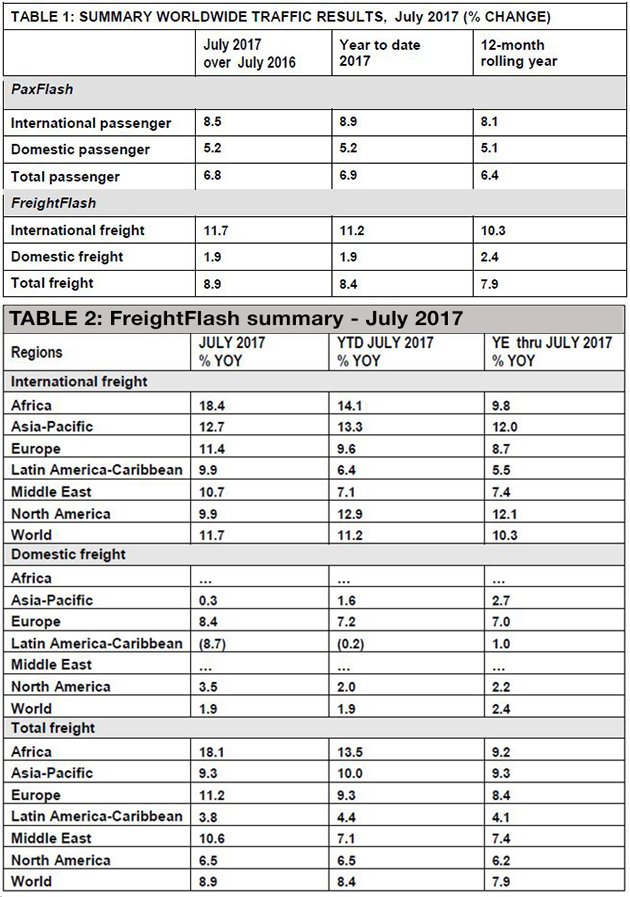

The same general pattern observed in July continued in August for most regions, with global year to date freight volumes reaching 8.7 per cent. North America and Latin America-Caribbean, which lagged behind in July, rallied to the global growth trend and reached 10.1 per cent and 9.1 per cent growth. Here again, Africa recorded particularly high numbers, reaching 21.6 per cent and boosting its year to date figure to 14.7 per cent.

At the country level, Kenya was a significant contributor with a 66.7 per cent increase in freight. Although Nigeria experienced an improvement in passenger traffic, its freight volumes declined by 6.4 per cent compared to the previous year.

Nairobi (NBO), Kenyaís main airport, recorded a 75.5 per cent year-over-year increase in freight volumes. Having been in negative territory for several months in the past year, the airport was able to recover its freight traffic and surpass previous volumes.

Global passenger traffic increased 6.7 per cent in August and 6.8 per cent year to date.

Africa and Europe led passenger traffic growth for August at 9.6 per cent and 8.9 per cent respectively on a year-over-year basis.

Africaís growth rate has accelerated since May, signalling that the regionís negative drag on traffic may be subsiding. Commodity prices have recovered since January 2017, translating into a positive outlook for the region. Although most African economies recorded passenger traffic growth during the month, northern and north-eastern African countries posted particularly high figures. Of the regionís largest aviation markets, Egypt (+20.1 per cent), Morocco (+14.2 per cent) and Tunisia (+12.1 per cent) recorded the highest growth rates. Nigeria, which emerged from recession in the second quarter of 2017, grew 8.2 per cent in August - potentially marking a turning point for the countryís embattled passenger market.

Europe's domestic passenger traffic slowed, posting growth of 5.9 per cent (down from 8.4 per cent in July). This is a return to the long-term trend as growth in Europe is driven primarily by the international segment. The latter grew at 10.1 per cent in August, down from 10.5 per cent in July. Although the region's advanced economies recorded strong growth in recent months, eastern and south-eastern Europe have contributed increasing shares to the region's total growth. Turkey and the Russian Federation, growing at 18 per cent and 15.6 per cent respectively, both continued to recover from a difficult period during 2016 and early 2017, boosting the region's numbers.

At the airport level, Antalya Airport (AYT) posted a record-level growth rate of 55.3 per cent for the month. In Africa, Cairo (CAI), which experienced a particularly difficult period between May and July, finally returned to growth with 6.6 per cent growth on a year over year basis.