New analysis says Asia- Pacific will be dominant in global infrastructure investment decisions

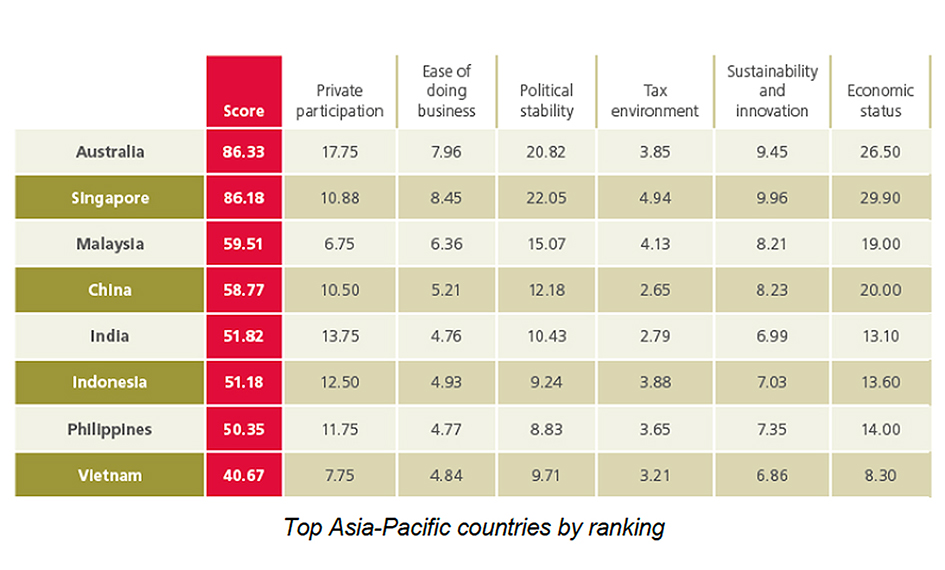

AUSTRALIA, Singapore and China are driving increased interest in infrastructure investment in the Asia-Pacific region, according to international law firm CMS’ Infrastructure Index: A New Direction, which ranks 40 jurisdictions in order of infrastructure investment attractiveness according to six key criteria.

Four of the top 20 spots for investment attractiveness were secured by Asia-Pacific countries, with robust economic growth across the region, ambitious renewables plans and the world’s largest infrastructure project - China’s Belt and Road - set to re-shape the continent’s landscape over the next decade.

Netherlands claims top spot

The Netherlands claimed top spot overall after posting its highest GDP growth since 2007, expected to reach 3.3 per cent for the 2017 year.

The country’s success was in part down to its transparent and efficient procurement process, and its healthy multi-billion-euro pipeline in road and water Public-Private-Partnerships (PPPs). Other countries in the top five were Canada, Germany, UK and Australia.

Kristy Duane, CMS partner and co-head of Infrastructure and Project Finance in the UK said: “From China’s Belt and Road to the UK’s Brexit bump in the road, politics and policy remain central to shaping infrastructure investment flows globally.

Kristy Duane, CMS partner and co-head of Infrastructure and Project Finance in the UK said: “From China’s Belt and Road to the UK’s Brexit bump in the road, politics and policy remain central to shaping infrastructure investment flows globally.

“If governments are to attract the private capital available, they should look to countries like the Netherlands and Canada for inspiration where transparency and a clear strategic vision for infrastructure shapes the agenda.

“The CMS Infrastructure Index charts shifts in the attractiveness of 40 countries across the globe and also highlights changes occurring in the infrastructure asset class, bringing a new wave of innovation to a market long dependent on standardised PPPs for much of its deal flow. The quest for deals has already prompted the industry to explore less mature sectors such as energy storage, broadband, smart meters, student accommodation and rolling stock. It is fascinating to see which countries are leading the way.”

China

China’s Belt and Road initiative continues to deliver on the promised infrastructure boom in Asia. Given the longevity of this project, changes in the balance of infrastructure investment in the region are likely to be profound. Though ranked at 20th position in the Index, China is primed to become a global engine of investment, with close to a trillion dollars expected to flow through the initiative by its completion, while highly ranked countries such as Australia and Singapore continue to benefit from stable and prosperous economies.

Australia’s federal target of 33,000GWh generated from renewable sources by 2020 has led to vast investment in solar and wind projects, and Singapore’s multi-billion-dollar development of Changi Airport’s Terminal 5 and the Tuas shipping megaport will solidify its position as a premier transport and trade hub globally.

Further afield, opportunities in Malaysia and India are plentiful, with renewable energy set to play a central role in future projects.

Adrian Wong, partner at CMS Singapore said: “The Asia-Pacific region is home to some of the world’s fastest-growing economies and most ambitious infrastructure projects, and the spread of four countries within the Index top 20 reflects an ever-developing opportunity for investment. While key success factors like government stability and political certainty cannot be ignored, the potential impact of the Belt and Road initiative alone promises to stimulate economic growth through the continent and far beyond.”

Doctor Nicolas Wiegand, partner at CMS Hong Kong added: “The risks of adverse government interference that are typically associated with investing in the Belt and Road jurisdictions are mitigated through an extensive and ever-expanding network of Asia’s investment treaties and free trade agreements with integrated investment chapters. In addition to investment treaties, the political risk insurance industry in the Asia-Pacific region has developed sophisticated insurance policies for insuring foreign investment in volatile Asian jurisdictions. As with previous years, investor-State arbitration remains an efficient tool to protect foreign investments in Asia, with Chinese companies becoming increasingly frequent users of investor-State dispute settlement mechanism.”

Europe

European countries have bounced back after a period of stagnation. Quantitative easing, the Juncker Plan and EIB support have all contributed to accelerated levels of EU infrastructure spending in recent years, and with economies such as Czech Republic and Romania experiencing significant expansion, there is room for optimism for future investment, according to the report.

Europe as a whole has experienced an upsurge in infrastructure investment, as many politicians have used infrastructure investment as an economic stimulant. As well as the Netherlands and the UK, Germany, Norway and France all ranked highly in the study, particularly for innovation. In Germany, all dominant parties have placed their support behind PPPs, and it is expected that deal flow, particularly in large-scale transport PPPs, will stay the course.

In the UK the impact of Brexit and general political instability is already starting to have an impact on infrastructure investments, as investors struggle with a lack of certainty in the country. Those operating across the sector are clearly looking for commitment and long-term policy from government to allay fears. The report highlights in particular the lack of consensus over infrastructure mega-projects such as a third Heathrow runway.

In the Americas, Canada leads the way, while a lack of detail on Trump’s proposed US$1 trillion US infrastructure project leaves the US lagging behind in seventh position. Notably, the Canadian government is to launch the Canadian Infrastructure Bank in 2017, providing a boost to the already reliable infrastructure market.

UAE

In other regions, MENA has succeeded in looking at alternatives to combat ongoing low oil prices. UAE and Saudi Arabia both have shown a keen interest in renewables. UAE has already played a pioneering role in exploiting high levels of solar irradiation, while Saudi Arabia’s recent commitment to clean energy is hailed as a game changer for the regional pipeline.

The report also highlights potential new emerging asset classes including 4G, charging stations, car parks and technologies which already have started to revolutionise infrastructure. One example is the rise of smart roads and smart cities, thanks to the interaction of road sensors, fibre optic networks, interconnected self-driving vehicles and inductive charging roads laying the foundations for a new generation of self-charging and self-driving electric vehicles. Cities like Dubai and Singapore are already making strides to lead the next wave of digital innovation.