November’s freight volumes up ‘substantially’ thanks to global freight impact, says ACI World

- News Feed

- Tuesday, 20 February 2018

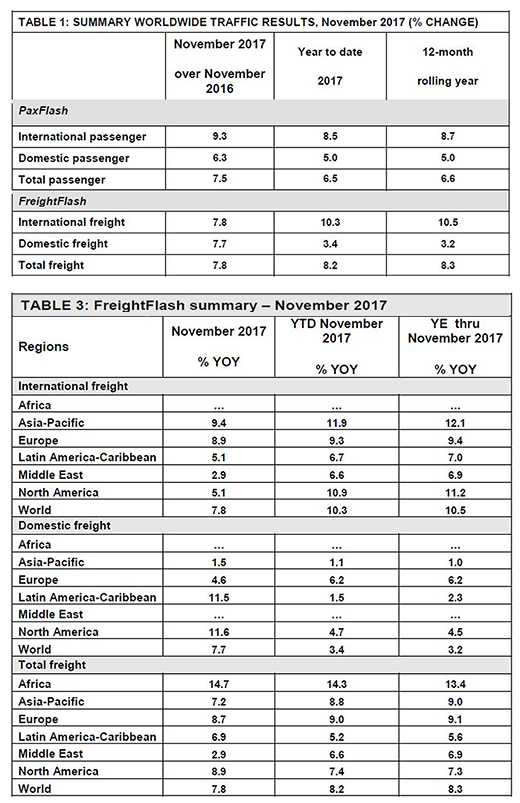

AFTER posting more moderate growth during October, November’s freight volumes rose substantially, reaching +7.8 per cent on a year-over-year basis.

Standing at +8.2 per cent on a ‘year-to-date’ (November) basis and with only one month left to tally in 2017, global freight figures are bound to show record growth for 2017.

The strong growth in volumes in November was thanks to global trade, according to the latest report from Airports Council International (ACI) World.

Africa, North America and Europe once again topped growth figures for total freight, reaching +14.7, +8.9 and +8.7 per cent respectively.

Asia-Pacific (+7.2 per cent), Latin America-Caribbean (+6.9 per cent) and the Middle East (+2.9 per cent) followed, the latter starting to regain speed after slowing down to +1.3 per cent in October. On a year-to-date (November) basis, all regions were posting growth of more than five per cent.

International freight drove most of the increases, reaching +7.8 per cent after slowing down to +4.4 per cent over the three months prior to November. Airports in the Asia-Pacific region led volumes handled for export and overall growth.

Double-digit growth in total freight volumes will be achieved for airports as a whole in the region for 2017.

At the local level, large markets have been contributing to this success, with India (+17.9 per cent), China (+16.7 per cent), Japan (+12.8 per cent) and Thailand (+11.5 per cent) leading on a year-to-date basis, and Hong Kong (+9.5 per cent) following close behind (for international trade volumes). The United States, the largest domestic freight market in the world, saw significant strides in volumes, increasing by +5.1 per cent on a year-over-year basis. In Europe, growth was boosted by strong numbers in Spain (+15.6 per cent), the United Kingdom (+13.2 per cent) and Turkey (+11.3 per cent). All three of these countries had year-to-date numbers reaching double-digit growth.

Passenger traffic

Meanwhile, global passenger traffic was up 7.5 per cent in November on a year-over-year basis. This was above the already-robust 6.5 per cent year-over-year from January to November.

Asia-Pacific (+10.6 per cent), Africa (+10.5 per cent) and Europe (+8.1 per cent) all posted particularly high growth in November. International traffic was a key driver for these increases, especially for European and Asia-Pacific markets. Strong overall business and consumer confidence continued to boost carriers offering low cost options. Africa continued to experience a strong recovery, following the recession that affected the continent’s largest economies Nigeria and South Africa.

On the other hand, Asia-Pacific’s domestic traffic rose significantly during the month, reaching +9.3 per cent. The figure remained below the region’s international traffic growth, however, which stood at +12.9 per cent.

Total passenger traffic in North America, Latin America-Caribbean and the Middle East grew at a more moderate pace, reaching +4.8, +3.8 and +3.5 per cent respectively.

Both North America and Latin America-Caribbean were negatively affected by weather events during September, the effects of which are progressively receding. The Middle East’s growth in passenger traffic was still disrupted by tensions between major players in the region, with internal strife disrupting Yemen and the partial blockade against Qatar still in place.

At the local level, Asia-Pacific’s largest markets enjoyed significant growth in November, with Indonesia’s passenger traffic rising at +17.9 per cent for its major commercial airports, Thailand at +15.9 per cent, India at +14 per cent and China at +12.5 per cent. On a year-to-date basis, India and Indonesia are set to post double-digit growth for 2017.

Latin America-Caribbean international passenger traffic reached +6.5 per cent, close to its year to date figures of +6.6 per cent, after suffering a decline in October. This recovery could bring the region’s growth rate to more than seven per cent by end year.

Current global growth by November’s end was 6.5 per cent, in line with 2016 numbers. Unless December numbers bring surprises, this year should bring another period of high growth for the airport industry.