Air cargo industry hoping 2020 isn't a copy of last year's depressing figures

- News Feed

- Friday, 07 February 2020

The International Air Transport Association (IATA) says 2019 was one of the worst years for global air freight, at least since the global financial crisis in 2009 (when air freight markets contracted by 9.7 per cent).

The industry's performance last year was impacted by weak growth in global trade of just 0.9 per cent coupled with slowing GDP growth in manufacturing-intensive economies, softer business and consumer confidence and falling export orders.

The outlook for 2020 is not being helped by the 'new coronavirus', which was first reported by Beijing, but has rapidly spread globally in the past two months - although with few fatalities outside China so far.

"Trade tensions are at the root of the worst year for air cargo since the end of the Global Financial Crisis in 2009. While these are easing, there is little relief in that good news as we are in unknown territory with respect to the eventual impact of the coronavirus on the global economy.

"The restrictions being put in place mean a drag on economic growth. And, for sure, 2020 will be another challenging year for the air cargo business,” said Alexandre de Juniac, IATA’s director general and ceo.

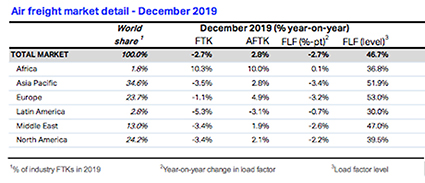

Regional performance

All markets except Africa suffered volume declines in 2019. Asia-Pacific retained the largest share of FTKs, at 34.6 per cent. The share of freight traffic increased modestly for both North America and Europe, to 24.2 per cent and 23.7 per cent respectively. Middle East carriers’ traffic share held steady at 13 per cent. Africa and Latin America saw their shares lift marginally, to 1.8 per cent and 2.8 per cent.

• Asia-Pacific carriers in December posted a decrease in demand of 3.5 per cent compared to the same period a year earlier. Capacity increased by 2.8 per cent. The full-year 2019 saw volumes decline 5.7 per cent, the largest decrease of any region, while capacity increased by 1.1 per cent. As the world’s main manufacturing region, international trade tensions and the global growth slowdown weighed heavily on regional air freight volumes in 2019. Within-Asia FTKs were particularly affected (down eight per cent compared to a year ago).

• North American airlines saw volumes fall by 3.4 per cent in December, while capacity grew by 2.1 per cent. For 2019 in total, the region’s cargo volumes declined by 1.5 per cent, compared to a capacity increase of 1.6 per cent. Trade tensions and cooling US economic activity in the latter part of the year have been factors in the decline. The 5.6 per cent fall in international year-on-year volumes in December was the weakest monthly growth outcome for the region since early 2016.

• European airlines experienced a 1.1 per cent year-on-year decrease in freight demand in December, with a capacity rise of 4.9 per cent. The fall in December was typical of the performance for 2019 as a whole, where volumes fell 1.8 per cent, but capacity increased by 3.4 per cent. Softer activity, including in the manufacturing-intensive German economy, combined with ongoing Brexit uncertainty contributed to the 2019 result, which in international freight volume terms was the weakest since 2012.

• Middle Eastern carriers’ freight volumes decreased 3.4 per cent year-on-year in December and capacity increased by just 1.9 per cent, the lowest of any region. This contributed to an annual result of a decline in demand of 4.8 per cent in 2019 – the second greatest decline in growth rate of all the regions. Annual capacity increased just 0.7 per cent. Disruption to global supply chains and weak global trade, together with airline restructuring in the region, were the chief drivers of the weaker freight outcome.

• Latin American airlines suffered the sharpest fall in demand of any region in December, of 5.3 per cent. The region was also the only one to see a reduction in capacity (-3.1 per cent). Although the region was the second strongest performer across 2019 as a whole, limiting its decline in volumes to just 0.4 per cent, social unrest and economic difficulties in several key countries led to the weakest international FTK outcome since 2015. Annual capacity increased 4.7 per cent.

• African carriers’ saw freight demand increase by 10.3 per cent in December 2019 compared to the same month in 2018. This was reflected in the strong 2019 full-year performance, which saw Africa freight volumes expand 7.4 per cent. Capacity in December grew by 10 per cent and for 2019 in total, increased by 13.3 per cent. Over the year, air cargo volumes have been supported by strong capacity growth and investment linkages with Asia.