-

Magazine Stories August Issue 2008

-

Saturday, 21 June 2008

SINGAPORE Customs has reminded forwarders and shippers that the advance submission period for TradeNet strategic goods permits, with complete supporting documents, is five working days.

Without being impolite enough to suggest that some people aren’t sufficiently clued up on regulations, Fauziah Sani, head of the Trade Control Branch, has suggested in a memo to agents and shippers that they have a good read of Customs Circular 35/2007 dated December 3 last year.

Better still, she suggested, it would be a good idea to get a hard copy of the legislation and study it. Bookshop details were supplied to encourage this action.

If that still didn’t clarify the regulation, a phone call or email to Revenue House would surely do the trick.

Singapore Customs now has a new director-general but it’s very much business as usual, with no changes to procedures or systems. Fong Yong Kian, who took over earlier this year, has a strong background in administrative service, including postings in the Ministry of Defence, Ministry of Home Affairs and Ministry of Finance.

He is enthusiastic about his new role, commenting that “I am excited to be part of the team to strengthen Singapore’s global trade hub position and bring about a positive impact for the trading community.”

His predecessor, Teo Eng Cheong, has moved on to a new challenge as chief executive of the Competition Commission of Singapore.

Teo’s nearly three and a half years with Customs were momentous ones for the organisation. Systems such as the Zero-GST Warehouse Scheme, Strategic Trade Scheme and Secure Trade Partnership Programme were introduced under his command. He also led the development of TradeXchange and oversaw the successful launch of TradeNet version 4.0.

-

Magazine Stories August Issue 2008

-

Saturday, 21 June 2008

MOST carriers have hubs; some have several. Seldom, however, has a catchphrase caught on so quickly and enduringly as SriLankan Cargo’s ‘Hub in the Ocean’.

Now the concept has been extended to passenger operations, with SriLankan Airlines successfully promoting Colombo as a transit or stopover point.

For cargo movements, Colombo’s Bandaranaike International Airport is a strategic locale between Australasia/Southeast Asia and Europe, as well as being a key gateway to and from India.

Recently, SriLankan achieved the impressive milestone of operating more than 100 flights weekly between Colombo and Indian cities New Delhi, Mumbai, Bangalore, Hyderabad, Chennai, Trichy, Trivandrum, Kozhikode, Goa and Kochi.

Coimbatore joined the Indian station line-up late last year, extending UL’s coverage to another major industrial centre that is both a prime source and destination for cargo. Sitting near the border of Tamil Nadu and Kerala, it is the second biggest city in Tamil Nadu.

On the eastern side of the network and with trade booming between India and the Asia-Pacific basin including Australia and New Zealand, SriLankan Cargo sees itself playing an increasingly significant role in the movement of perishables, electronics and a wide range of other commodities.

There also is more scope for tapping India’s logistics resources for JIT deliveries to markets in this part of the world.

As the ‘Hub in the Ocean’, SriLankan Cargo and Colombo have become integral parts of the supply chain for many leading brand manufacturers who depend heavily on JIT delivery of raw material from suppliers and finished goods to customers.

UL takes considerable pride in living the concept of ‘shipped as booked’.

While Bandaranaike International has experienced some much-publicised security problems in the past, it is now a totally secure and fully-operational airport whose cargo handling facilities have been upgraded and are capable of handling more than the current throughput.

The airport’s cargo tonnage throughput has been rising steadily for six years.

The first three months of 2007 saw a massive 34 per cent increase in fruit, vegetable, cut flower and fish exports from Sri Lanka on UL cargo services. The carrier has fostered links with even smaller growers to develop this trade. Prime markets include resorts in the Maldives and customers in the Middle East, with UL freighters handling much of the traffic.

SriLankan Cargo has built increasingly strong links between Colombo and the Middle East, using both freighters and belly-hold space on the carrier’s passenger services.

Construction-related material from Australia is among the fast-growing cargo traffic to the Middle East, notably to the Kingdom of Saudi Arabia.

On the web: www.srilankancargo.com

-

Magazine Stories August Issue 2008

-

Saturday, 21 June 2008

VIETNAM Airlines has signed an exclusive general sales agency agreement with Globe Air Cargo for eight countries in Europe and extended the company’s responsibilities to include capacity management, export and import handling supervision and equipment control.

Under the terms of the new contract, Globe is now the exclusive cargo GSA for Vietnam Airlines in France, Belgium, Bulgaria, Czech Republic, Hungary, Poland, Romania and Slovakia. Globe will also continue to represent the airline in other locations in Europe.

From Paris CDG, the carrier currently operates six B777 flights a week. Three flights — Monday, Wednesday and Saturday — serve Noibai International Airport and three more operate to Tan Son Nhat International Airport on Tuesdays, Fridays and Sundays.

M Le Dung, general manager, France, of Vietnam Airlines, said: “Step by step, Globe has successfully built up Vietnam Airlines as a leading brand name in the air freight market on the routes to Vietnam and Indochina. Although this market is becoming tougher every day, Globe Air Cargo has maintained a good market share for us.

“The Vietnam cargo market for imports and exports is booming. Under our new exclusive agreement, we are confident Globe can achieve a higher market share into Vietnam as well as increasing our business into Asia. Globe will also help us improve the quality of our service by controlling and supervising handling for both import and export cargo and speeding up the flow of information to our customers.”

Guy Tordjman, president of European Cargo Services, said: “This is a major contract win for Globe Air Cargo and demonstrates the full range of services we can provide for airlines at multiple locations in their networks. As well as the thriving market to and from Vietnam, we will also be taking advantage of Vietnam Airlines’ excellent flight connections to Australia, China, Japan, Korea and Thailand to maximise the airline’s cargo revenues and yields.”

Meanwhile, the Vietnamese government has licensed the country’s first privately owned airline, Vietjet. The new carrier says initially it will operate domestic routes between Hanoi, Ho Chi Minh City and Danang next year and hopes eventually to offer flights to Hong Kong, Singapore and Bangkok. It joins the country's three state-owned airlines: Vietnam Airlines, Pacific Airlines and Vasco.

-

Magazine Stories August Issue 2008

-

Saturday, 21 June 2008

SEATTLE, US-based Air Cargo Management Group (ACMG) has released the latest edition of its annual Twenty-Year Freighter Aircraft Forecast.

SEATTLE, US-based Air Cargo Management Group (ACMG) has released the latest edition of its annual Twenty-Year Freighter Aircraft Forecast.

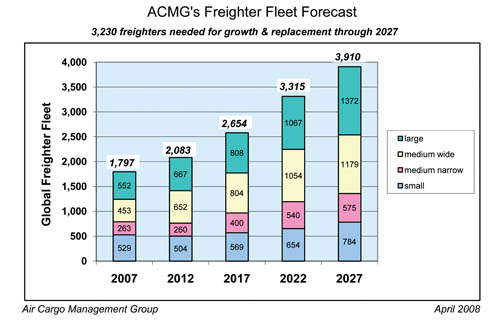

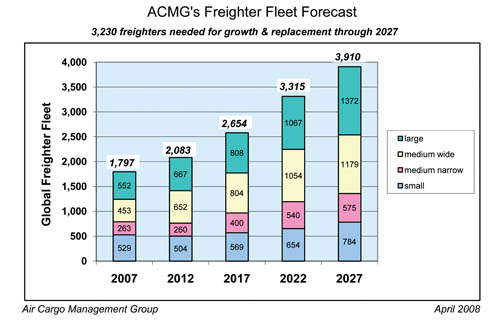

The forecast shows that the global freighter fleet will more than double in size from 797 units now to 3910 units in 2027 (see chart right). “In addition to freighter fleet expansion to meet the growing demand for air freight services, more than 1100 existing freighters will be retired over the next 20 years,” said Robert Dahl, ACMG’s project director. “Taking both growth and replacement into account, ACMG predicts the need for more than 3200 new and converted freighters through 2027, an average of 160 units added per year.”

ACMG’s forecast is based on a long-term growth of six per cent per year in the demand for air freight services. By 2027 over 65 per cent of the freighters will be wide-body types, up from a 55 per cent share of the fleet today. The industry’s dependence on conversion of passenger aircraft to freighter con-figuration will continue. Through 2027 ACMG predicts 2295 used aircraft will be converted to freighter configuration, with another 935 new production freighters to be built.

However, in the large freighter segment, production freighters added will outnumber conversions 675 to 410 over the next twenty years. “The sales success of the new 777F, 747-8F and A330-200F models that will enter service in the next two years clearly demonstrates the market preference for new aircraft in the larger freighter segments. These new production models have a distinct advantage in a market with high fuel prices and growing concern about aircraft emissions,” said Dahl.

“The new document reflects a slight decline in the number of freighters in the world over the past year,” he added. “However, taking into account the increasing share of wide-body types, we find that the capacity of the freighter fleet grew about 3 per cent despite the slight decline in the total fleet count.”

The stagnation of the fleet is due in part to a lack of passenger-configured aircraft to provide feedstock for the numerous freighter conversion programs that are now available for virtually every model of aircraft. The feedstock issue will be resolved in the coming years, based on accelerating delivery of A380 and 787 model aircraft, and the anticipated consolidation among US legacy passenger airlines that are expected to reduce their system-wide capacity.

The analysis also includes:

• A forecast of freighter aircraft requirements on a model-by-model basis in five-year increments through 2027.

• Analysis/commentary on 18 aircraft types that will dominate the future freighter market.

• A summary of the production status, performance characteristics, conversion program availability, and main attributes determining the suitability of each model as a freighter candidate.

• A discussion of new-build freighter aircraft and aircraft converted from pas-senger-to-freighter configuration, along with an assessment of the retirement of existing freighters.

The forecast was released at the company’s 6th Annual Air Cargo, Express, and Freighter Aircraft Workshop held this month in Seattle, and is now available for sale.

To obtain a copy of the forecast contact Robert Dahl at This email address is being protected from spambots. You need JavaScript enabled to view it..

-

Magazine Stories August Issue 2008

-

Saturday, 21 June 2008

THE SIGNING of a Free Trade Agreement between China and New Zealand underlines the significance of Air New Zealand’s decision to boost services between the two countries - one big and booming, the other small and determined to improve its export reach, writes Kelvin King.

Air New Zealand currently operates passenger/freight services to Shanghai and Hong Kong, as well as featuring Shanghai on its round-the-world freighter service.

Chinese ports are to be extended soon, with the opening of a Beijing station.

Air New Zealand is well positioned to maximise opportunities generated by the FTA and private marketing initiatives. It has restructured its cargo operations, bringing all freight components into one chain of command.

Kelvin King talked with Rick Nelson, who has taken command of all Air New Zealand’s cargo operations. Nelson was previously responsible for national (or domestic) operations and has earned considerable praise for rebuilding — and significantly growing — the carrier’s freight business within New Zealand after years of outsourcing most aspects of it.

Nelson said that the strategy behind NZ bringing all cargo operations back under a single chain of command was “in a nutshell, to position the cargo business for growth. Bringing all cargo operations under one single chain of command, with centralised planning and revenue management, enables us to create a stronger commercial focus, with an emphasis on efficiency and continuous improvement.

“It will provide driven leadership for the cargo business and allows us to build a stronger relationship with our customers.

“There is a need for a closer relationship between the regional passenger and cargo businesses. The move allows us to re-establish the cargo business while retaining the positive aspects that have been established as a result of the previous structure.

“We believe it will allow us to optimise the performance of each core business - international sales, national cargo, cargo operations and freighter — and to leverage business opportunities across the cargo group where appropriate.”

Management team

Nelson now heads an integrated management team boasting a wealth of knowledge and hands-on experience in the air cargo sector.

Sandro Penzo has become manager, international cargo sales, a job that differs markedly from his previous manager sales position. “The responsibility for the commercial functions and new business ventures has been moved to the newly created role of manager cargo commercial and ventures.

“This enables a new level of focus and dedication to the core sales business,” Nelson explains.

The regional cargo roles remain virtually unchanged, except that their formal dotted lines have been developed to their respective regional general managers.

Cynthia O’Neill takes on the new role of manager, cargo commercial and ventures, which straddles the total commercial business.

The aim, explains Nelson, is to ensure that the commercial team can provide quality information to the business to promote better decision-making, consistency and simplicity around the business processes.

“This also marks the beginnings of transitioning the business towards more centralised planning, capacity and revenue management which will ultimately be supported by the new cargo IT solutions,” says Nelson.

He stresses, however, that NZ “will strive to maintain a balance between centralisation and the empowerment and entrepreneurial nature of the current business structure, in particular the offshore regions, as this is widely recognised as a competitive advantage for Air New Zealand.”

O’Neill’s new role will also have a large focus on new business development, both within and outside the existing core businesses. “This will include seeking and assessing new opportunities and taking those deemed viable to the stage where they are commercialised before integrating them into the core business.”

Manager national cargo is Maria Dyason. This role is largely unchanged, Nelson points out, but “as the business matures from the start-up phase, the focus will begin to shift from business and process development through to business and process management and refinement”.

Jon Calder is manager international cargo operations, another role which remains largely unchanged from the old manager cargo operations title. However, says Nelson, “it now assumes full ownership and responsibility for the management of commercial arrangements and relationships with customer airlines”.

Stephen McKeefry has become cargo standards and safety manager. “This is a newly-created role and recognises the increasing importance of the security and regulatory environment within our business and ensures that the business drives and delivers leadership compliance requirements.

“The role assumes responsibility for total network operational security, legislative and regulatory compliance.”

Benefits to shippers and forwarders

AIR New Zealand Cargo has always been proud of its can-do attitude, says Nelson.

“Part of our medium and long term strategy is to become even more market-orientated as a total business with our customers. Their objectives must be central to everything we do.

“Operating as a cargo division enables a single management structure to be responsible for, and have ownership of, the customer experience throughout the entire part of the supply chain that we service as a carrier and ground handler.”

Business development priorities

NELSON says that Air New Zealand’s priorities include working with New Zealand freight forwarders and exporters to stimulate the NZ air freight market wherever possible, developing customised solutions that enhance profitability for Air NZ Cargo and customers, and “assessing opportunities to take a more global, rather than regional, perspective across business where that position makes commercial sense to both the business and our customers.”

Emphasis will also be put on product reviews “to ensure our products and services are aligned with customer requirements and the introduction of a ‘premium express plus’ product on high demand sectors to enable customers with ‘must go’ items to access capacity”.

Nelson says that NZ sees “significant opportunities for growth across our entire business portfolio. These will be realised through a series of continuous improvement programs and also a number of initiatives that potentially have the ability to deliver a step charge to our business.”

iCargo

NZ is currently working towards the implementation of iCargo, its fully-integrated cargo sales, operations and accounting IT system, in October. iCargo will be commissioned for national cargo in October this year and in April 2009 for the international business.

“We believe iCargo will enable significant positive process change across the entire cargo business,” says Nelson.

“The system will not only enable far better internal processes but will also enable significant enhancements for our customers such as electronic data exchange, online bookings, online cargo tracking and bar coding.”

Challenges, opportunities

FUEL prices and the volatility and current strength of the New Zealand dollar “naturally present some challenges,” Nelson notes.

“Our goal is to ensure that we remain entrepreneurial and nimble enough to keep pace and take advantage of any opportunities that are presented as a result of changing economic conditions, both within New Zealand and globally.”

Further opportunities for growth include freighter services and the China air cargo export market.

“We’re constantly seeking new air freight export opportunities into China which remains a relatively weak export air freight market from New Zealand, though demand from China has been very solid since the introduction of our services.”

Green initiatives

NELSON says the cargo team is embracing the carrier’s position on environmental issues and examining areas where Cargo can contribute to green initiatives.

“We support the establishment of the Air New Zealand environmental trust committed to funding research and development into alternative fuels and backing projects that enhance our country’s clean, green reputation.

“We will also be watching the innovative carbon credits scheme, whereby Air New Zealand passengers can choose to purchase carbon credits to offset their travel. While we currently have no specific plans around developing a similar Cargo program, we will continue to explore our options within this space.”

-

Magazine Stories August Issue 2008

-

Saturday, 21 June 2008

RECORD-breaking export performances at UK-based Alwayse Engineering are to be recognised by the Queen’s Award for Enterprise. Overseas sales of its ball transfer units — used in materials handling systems — have grown by 106 per cent during the past five years, equating to over £GBP12 million pounds of business. The family owned business is headed by Leon Pinnick, chairman, who has been involved with the firm for over 50 years.

RECORD-breaking export performances at UK-based Alwayse Engineering are to be recognised by the Queen’s Award for Enterprise. Overseas sales of its ball transfer units — used in materials handling systems — have grown by 106 per cent during the past five years, equating to over £GBP12 million pounds of business. The family owned business is headed by Leon Pinnick, chairman, who has been involved with the firm for over 50 years.

Alwayse invented the ball transfer unit in 1939, but the turning point came nine years ago, when it introduced a special unit for use in air cargo terminals. They are now used in airports all over the world, including China and India, with sales approaching the two million mark. These special units have had to compete with South East Asia manufactured competitors, and have won many orders in this region.

Managing director of Alwayse Engineering, Graham Golby, said: “We’re delighted to win the award, and for the second time, having previously won it in 1997.

“There’s no real secret to making export sales work other than hard work, but once we appoint an overseas distributor, we offer them our maximum support. We offer lots of technical help on our products, and also some financial assistance, with help to create advertisements, brochures and even exhibition stands. We have established some excellent distributors over many years, and this year we hope to establish sales in Romania, Eygpt, Vietnam and Slovenia. Currently the company exports 70 per cent of its production to over 60 countries worldwide.”

Its export success was recognised within the International Trade category of the Award. An official ceremony on Tuesday, 22 April at The Gladstone Library, London, saw the Duke of Gloucester make a formal presentation.

The business continues to grow, and it moved into a brand-new £GBP3 million pound, 35,000sq. ft factory in Miller Street, Birmingham in March, 2006. In addition to its mainstream UK and overseas sales, Alwayse has occasionally answered more unusual requests. It provided part of the solution to the infamous ‘wobbly’ Millennium Bridge, and has also supplied special units to the US Air Force in Alaska, capable of withstanding extreme cold conditions.

SEATTLE, US-based Air Cargo Management Group (ACMG) has released the latest edition of its annual Twenty-Year Freighter Aircraft Forecast.

SEATTLE, US-based Air Cargo Management Group (ACMG) has released the latest edition of its annual Twenty-Year Freighter Aircraft Forecast.  RECORD-breaking export performances at UK-based Alwayse Engineering are to be recognised by the Queen’s Award for Enterprise. Overseas sales of its ball transfer units — used in materials handling systems — have grown by 106 per cent during the past five years, equating to over £GBP12 million pounds of business. The family owned business is headed by Leon Pinnick, chairman, who has been involved with the firm for over 50 years.

RECORD-breaking export performances at UK-based Alwayse Engineering are to be recognised by the Queen’s Award for Enterprise. Overseas sales of its ball transfer units — used in materials handling systems — have grown by 106 per cent during the past five years, equating to over £GBP12 million pounds of business. The family owned business is headed by Leon Pinnick, chairman, who has been involved with the firm for over 50 years.