-

News Feed

-

Friday, 07 February 2020

With the phased implementation of 100 per cent air cargo security screening started, the U-Freight Group says it is well placed to assist shippers, with a logistics hub in Hong Kong certified by the Hong Kong Civil Aviation Department (CAD) as a Regulated Air Cargo Screening Facility (RACSF).

The enhancement of international standards on air cargo security by the International Civil Aviation Organisation (ICAO) commenced 01 January 2020 and will be implemented in phases to achieve 100 per cent screening by 30 June 2021.

To complement the anticipated gradual increase in screening demand, Hong Kong’s Civil Aviation Department (CAD) developed the RACSF (Regulated Air Cargo Screening Facility) scheme to enable and regulate air cargo screening at off-airport locations.

In Hong Kong, a transitional arrangement has been set up which will mean that all RACSFs are required to gradually increase the percentage of air cargo being screened.

Some 25 per cent of cargo (by weight) is required to be screened through to April 2020, increasing to 40 per cent in phase two from May to August 2020 then 70 per cent in phase three from September 2020 to February 2021 and 100 per cent in phase four from March to 30 June 2021 (the ICAO deadline).

Over two years ago, the U-Freight Group installed an X-ray machine at its Golden Bear Industrial Centre in Hong Kong, giving staff adequate time to gain experience in the scanning process, as well as helping to identify prohibited/suspect products inside the ever-increasing number of e-commerce parcels it handles.

A second enhanced X-ray machine can scan consignments up to pallet size. The company modified its export operations warehouse to accommodate the existing X-ray machine, as well as the newly-purchased one.

Simon Wong, UFL’s chief executive officer said: “The U-Freight Group fully supports the ICAO aviation security requirements and has worked closely with CAD, Hong Kong Airport Authority, Cargo Terminal Operator and HAFFA in making the necessary preparations to make sure that we enhance our air cargo security regime to meet new international aviation security requirements.

“The establishment of off-airport screening facilities in Hong Kong will enable air cargo to be screened at the existing warehouses or similar premises of the air cargo industry before such cargoes are transported to the airport for loading on aircraft.

“We were very keen to capitalise on this opportunity, and were very pleased to have become one of the first freight forwarders and logistics companies to have been accredited by CAD, and are now fully prepared to play our part in the new ICAO regime.”

-

News Feed

-

Friday, 07 February 2020

The International Air Transport Association (IATA) says 2019 was one of the worst years for global air freight, at least since the global financial crisis in 2009 (when air freight markets contracted by 9.7 per cent).

The industry's performance last year was impacted by weak growth in global trade of just 0.9 per cent coupled with slowing GDP growth in manufacturing-intensive economies, softer business and consumer confidence and falling export orders.

The outlook for 2020 is not being helped by the 'new coronavirus', which was first reported by Beijing, but has rapidly spread globally in the past two months - although with few fatalities outside China so far.

"Trade tensions are at the root of the worst year for air cargo since the end of the Global Financial Crisis in 2009. While these are easing, there is little relief in that good news as we are in unknown territory with respect to the eventual impact of the coronavirus on the global economy.

"The restrictions being put in place mean a drag on economic growth. And, for sure, 2020 will be another challenging year for the air cargo business,” said Alexandre de Juniac, IATA’s director general and ceo.

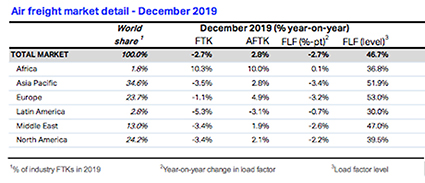

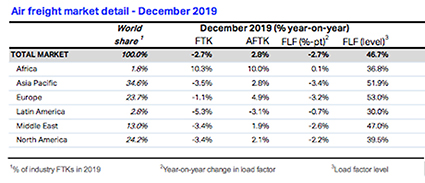

Regional performance

All markets except Africa suffered volume declines in 2019. Asia-Pacific retained the largest share of FTKs, at 34.6 per cent. The share of freight traffic increased modestly for both North America and Europe, to 24.2 per cent and 23.7 per cent respectively. Middle East carriers’ traffic share held steady at 13 per cent. Africa and Latin America saw their shares lift marginally, to 1.8 per cent and 2.8 per cent.

• Asia-Pacific carriers in December posted a decrease in demand of 3.5 per cent compared to the same period a year earlier. Capacity increased by 2.8 per cent. The full-year 2019 saw volumes decline 5.7 per cent, the largest decrease of any region, while capacity increased by 1.1 per cent. As the world’s main manufacturing region, international trade tensions and the global growth slowdown weighed heavily on regional air freight volumes in 2019. Within-Asia FTKs were particularly affected (down eight per cent compared to a year ago).

• North American airlines saw volumes fall by 3.4 per cent in December, while capacity grew by 2.1 per cent. For 2019 in total, the region’s cargo volumes declined by 1.5 per cent, compared to a capacity increase of 1.6 per cent. Trade tensions and cooling US economic activity in the latter part of the year have been factors in the decline. The 5.6 per cent fall in international year-on-year volumes in December was the weakest monthly growth outcome for the region since early 2016.

• European airlines experienced a 1.1 per cent year-on-year decrease in freight demand in December, with a capacity rise of 4.9 per cent. The fall in December was typical of the performance for 2019 as a whole, where volumes fell 1.8 per cent, but capacity increased by 3.4 per cent. Softer activity, including in the manufacturing-intensive German economy, combined with ongoing Brexit uncertainty contributed to the 2019 result, which in international freight volume terms was the weakest since 2012.

• Middle Eastern carriers’ freight volumes decreased 3.4 per cent year-on-year in December and capacity increased by just 1.9 per cent, the lowest of any region. This contributed to an annual result of a decline in demand of 4.8 per cent in 2019 – the second greatest decline in growth rate of all the regions. Annual capacity increased just 0.7 per cent. Disruption to global supply chains and weak global trade, together with airline restructuring in the region, were the chief drivers of the weaker freight outcome.

• Latin American airlines suffered the sharpest fall in demand of any region in December, of 5.3 per cent. The region was also the only one to see a reduction in capacity (-3.1 per cent). Although the region was the second strongest performer across 2019 as a whole, limiting its decline in volumes to just 0.4 per cent, social unrest and economic difficulties in several key countries led to the weakest international FTK outcome since 2015. Annual capacity increased 4.7 per cent.

• African carriers’ saw freight demand increase by 10.3 per cent in December 2019 compared to the same month in 2018. This was reflected in the strong 2019 full-year performance, which saw Africa freight volumes expand 7.4 per cent. Capacity in December grew by 10 per cent and for 2019 in total, increased by 13.3 per cent. Over the year, air cargo volumes have been supported by strong capacity growth and investment linkages with Asia.

-

News Feed

-

Friday, 07 February 2020

Chief executives globally are showing record levels of pessimism, with 53 per cent predicting a decline in the rate of economic growth in 2020.

This is up from 29 per cent in 2019 – and only five per cent in 2018.

The result is the highest level of pessimism since the survey started in 2012. By contrast, the number of CEOs projecting a rise in the rate of economic growth dropped from 42 per cent last year to 22 per cent now. These are some of the key findings of PwC's 23rd survey of almost 1,600 CEOs from 83 countries across the world.

Ceo pessimism over global economic growth is particularly significant in North America, Western Europe and the Middle East, with 63, 59 and 57 per cent of ceos from those regions predicting lower global growth in the year ahead.

"Given the lingering uncertainty over trade tensions, geopolitical issues and the lack of agreement on how to deal with climate change, the drop in confidence in economic growth is not surprising - even if the scale of the change in mood is," said Bob Moritz, chairman of the PwC Network. "These challenges facing the global economy are not new - however the scale of them and the speed at which some of them are escalating is new, and leaders need to find answers.

"Given the lingering uncertainty over trade tensions, geopolitical issues and the lack of agreement on how to deal with climate change, the drop in confidence in economic growth is not surprising - even if the scale of the change in mood is," said Bob Moritz, chairman of the PwC Network. "These challenges facing the global economy are not new - however the scale of them and the speed at which some of them are escalating is new, and leaders need to find answers.

"On a brighter note, while there is record pessimism amongst business leaders, there still are real opportunities out there. With an agile strategy, a sharp focus on the changing expectations of stakeholders and the experience many have built up over the past 10 years in a challenging environment, business leaders can weather an economic downturn and continue to thrive."

Falling confidence

Ceos also are not so positive about their own companies' prospects for the year ahead, with only 27 per cent of ceos saying they are "very confident" in their own organisation's growth over the next 12 months - the lowest level since 2009 and down from 35 per cent last year.

While confidence levels are generally down across the world, there is a wide variation from country to country, with China and India showing the highest levels of confidence among major economies at 45 and 40 per cent respectively, the US at 36 per cent, Canada at 27 per cent, the UK at 26 per cent, Germany at 20 per cent, France 18 per cent, and Japan having the least optimistic ceos, with only 11 per cent very confident of growing revenues in 2020.

When asked about their own revenue growth prospects, the change in ceo sentiment has proven to be an excellent predictor of global economic growth. Analysing ceo forecasts since 2008, the correlation between ceo confidence in their 12-month revenue growth and the actual growth achieved by the global economy has been very close. If the analysis continues to hold, global growth could slow to 2.4 per cent in 2020 below many estimates including the 3.4 per cent October growth prediction from the IMF.

Economic growth worries

In 2019 when asked about the top threats to their organisation's growth prospects, uncertain economic growth ranked outside the top 10 concerns for ceos at number 12. This year it has leapt to third place, just behind trade conflicts - another risk that has risen up the ceos agenda - and the perennial over-regulation, which has again topped the table as the number one threat for ceos.

Ceos are also increasingly concerned about cyber threats and climate change and environmental damage, however despite the increasing number of extreme weather events and the intensity of debate on the issue, the magnitude of other threats continues to overshadow climate change, which still does not make it into the ceos' top 10 threats to growth.

Policing cyberspace

While ceos around the world express clear concerns about the threat of over-regulation, they are also predicting significant regulatory changes in the technology sector. Globally, more than two-thirds of ceos believe that governments will introduce new legislation to regulate the content on both the internet and social media and to break up dominant tech companies. A majority of ceos (51 per cent) also predict that governments will increasingly compel the private sector to financially compensate individuals for the personal data that they collect.

However, ceos are in two minds as to whether governments are striking the right balance in designing privacy regulation between increasing consumer trust and maintaining business competitiveness, with 41 per cent saying it does strike the right balance and 43 per cent saying it doesn't.

-

News Feed

-

Friday, 07 February 2020

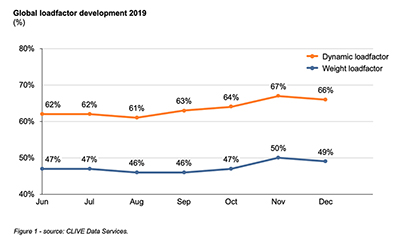

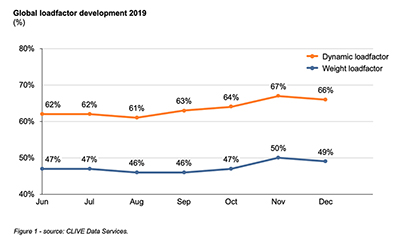

The Global utilisation of air cargo capacity is 35 per cent higher than the traditional industry indicator suggests, according to a new data services company offering a ‘dynamic load factor’ analysis.

It claims refreshing the way air cargo capacity use is measured to reflect modern day reality will strengthen the airlines’ voices with all stakeholders including airports, slot coordinators, legislators and aircraft manufacturers.

Clive Data Services claims air cargo load factors based on weight utilisation paint a misleading picture of how full flights really are.

“This is caused by the methodology used,” said Niall van de Wouw, managing director of Clive data Services.

“Traditionally, the amount of cargo flown in kgs is divided by the level of cargo capacity in kgs. But the reality for the vast majority of widebody and freighter flights is that it’s the cargo capacity in cubic metres that is the limiting factor, not the cargo capacity in kgs. Consequently, load factors based only on weight underestimate how full planes really are,  and thus give a distorted picture of how the industry is performing.

and thus give a distorted picture of how the industry is performing.

“The fact that flights nearly always ‘cube out’ before they ‘weigh out’ is a result of the aircraft’s higher capacity density (available kgs per cubic metre) than the average density of the goods moved by air. Looking ahead it is very likely that this discrepancy in capacity density and cargo density will further increase. On the capacity side, we have new planes entering the market that can lift more kgs of cargo per cubic metre than ever before. And, on the cargo side, the surge in e-commerce traffic will further decrease the average density of the cargo flown.”

Clive’s analysis shows the real utilisation of air cargo capacity on a global level is some 35 per cent higher than the traditional indicator suggests, he adds.

“We therefore believe it is time for a new yardstick: The dynamic load factor. To support this change in thinking, we will now be publishing a dynamic load factor analysis each month. It considers both the volume and the weight perspective of the cargo flown and capacity available. The analysis is based on flight data shared by a representative group of airlines operating to all corners of the globe. We believe this new yardstick will create a better understanding and more appreciation for the industry at regulatory and governmental levels.

“Going forward, in the first week of each month, we will be reporting an overview of the load factor trends for the previous month to ensure the industry has access to both the most accurate and most recent data,” de Wouw said.

The results of this new analysis will paint a more realistic picture of how air cargo capacity on a global level is being used (see figure 1 above).

-

News Feed

-

Friday, 07 February 2020

Well, it finally happened. 1,317 days, two elections and a number of pieces of legislation after the UK voted to leave the European Union (EU), the departure procedures commenced, writes Andrew Hudson.

On 31 January 2020, Britain formally resigned its position within the EU. However, reports of the spilt as a ‘divorce’ probably overstated the position given that there were few immediate consequences. It’s more of a ‘conscious uncoupling’ (to quote Gwyneth Paltrow), with many of the details yet to be finalised and the parties largely continuing to live together until the details can be worked out. The next real deadline is the end of the year, at which time the UK and EU will have negotiated a formal exit arrangement, agreed to an extension of time or, if not, will have moved to a version of a ‘no deal’ Brexit in which United Nations World Trade Organisation (WTO) default trading arrangements between countries’ will apply. There is some confidence that a Free Trade Agreement (FTA) and other agreements governing the relationship can be secured by 31 December 2020, but their form and content could be one of several versions.

The current state of the arrangements applying to trade between the two is as follows:

• The EU (Withdrawal) Act has come into force in the UK commencing a transition period until 31 December 2020.

• The EU has passed a resolution accepting the withdrawal. UK, members of the EU Parliament have withdrawn.

• The UK became a separate WTO member from 1 February 2020 and no longer has to ‘sit at the back’ of the room as an observer without a right of separate representation.

• The UK has now ‘opened for business’ a number of separate trade representative offices around the world extolling the virtues of business with the UK outside the EU.

• The EU and the UK will negotiate a new economic and security relationship, (including a new agreement on trade, whether some form of FTA or otherwise) based on the concepts contained in the ‘Polit ical Declaration on the EU-UK future relationship’.

• The EU and the UK will negotiate a new economic and security relationship, (including a new agreement on trade, whether some form of FTA or otherwise) based on the concepts contained in the ‘Polit ical Declaration on the EU-UK future relationship’.

• The UK can’t start FTA negotiations with other countries until the EU transition is at an end.

• Those countries with an FTA with the EU now can treat the UK separately but aren’t expected to do so. For example, Singapore has already confirmed that it will continue to treat the UK as part of the EU as part of its FTA with the EU.

• The EU-UK transition will last until 31 December 2020. Under the Withdrawal Agreement, it can be extended for up to two years if the EU and the UK agree to do so. However, at present, the UK Government’s stated intention is not to seek or agree to an extension, even though it is written into UK law as an option.

A ‘no deal’ outcome on trade remains a possibility if the EU and the UK fail to conclude a new trade agreement before 31 December 2020 and the transition period is not extended. In that case, with effect from 1 January 2021, the basis for EU-UK trade would automatically default to WTO terms. There are a number of other consequences in other areas. For example, UK citizens are no longer formally EU citizens but will be treated as such for the time being.

The UK has indicated that a priority from January 1 2021 will be to secure FTAs with major trading partners such as the EU, the US and Canada, together with its ‘traditional friends’ such as NZ and Australia. The UK prime minister Boris Johnson (pictured) has stated that the UK would prefer to have a ‘comprehensive’ and ‘frictionless’ FTA with the EU like the EU’s deal with Canada (which took years to negotiate). In lieu of such a deal, he has stated that he would even settle for a ‘bare bones’ FTA with the EU focused only on reducing tariff levels and Customs issues ‘such as Australia has with the EU’.

That is an odd position for two reasons. Firstly, Australia does not have an FTA with the EU. Secondly, describing our FTAs as ‘bare bones’ is somewhat misconceived. We describe our FTAs as ‘comprehensive’ and certainly the best deals which could be done at the time. Any ‘frictionless’ FTA between the EU and the UK also could be difficult to achieve as the EU has already set some negotiating ‘red lines’ that are unacceptable to the UK because they require relinquishing ‘sovereignty’ on some issues - and the UK left the EU to recover just that sort of sovereignty.

Beneath all the rhetoric there seems to be a real likelihood that there will be a ‘harder’ trade border between the EU and the UK than has been in place for 48 years.

For Australian exporters and importers, much will depend upon any FTAs we can reach with the UK and the EU. There are already some small agreements in place but any growth in trade would require substantial cuts to tariffs, quotas and barriers for our farmers, investors and winemakers. Whatever happens, the benefits may not be as significant as have been predicted as, after all, the ‘tyranny of distance’ has always been the major impediment to  Australia’s trade with the EU and UK. Our exporters will also need to be careful of new regulations and procedures to be introduced at the UK border along with new standards and exposure to the UK’s new ‘dumping regime’.

Australia’s trade with the EU and UK. Our exporters will also need to be careful of new regulations and procedures to be introduced at the UK border along with new standards and exposure to the UK’s new ‘dumping regime’.

Stay tuned for more updates as the smoke (and virus) clear.

-

News Feed

-

Tuesday, 26 November 2019

DESPITE Brexit woes, US-China trade wars and an economy in Australia that’s on life support, DHL and its customers are confident the economy is going to turn for the better next year and DHL’s new Annual Export Barometer 2019 is very bullish on potential exports in 2020.

The report reveals that 69 per cent of Australian exporters are confident the coming 12 months will bring an increase in overseas orders for their businesses. Furthermore, 56 per cent of exporters reported an increase in actual orders in the past 12 months, mirroring figures from 2017.

At a state and territory level, exporters based in New South Wales/the Australian Capital Territory (69 per cent) and Victoria (65 per cent) recorded a decline in confidence, while South Australia/the Northern Territory (75 per cent), Western Australia (72 per cent), and Queensland (71 per cent) all showed increases this year.

New Zealand and North America remain top destinations

New Zealand retains its top spot as the most-popular destination for Australian businesses at 68 per cent this year. Since 2013, New Zealand has been the preferred market for Australian exporters and the only one to experience steady growth, rising 17 per cent over this period.

The North America region is in second place, with 52 per cent of Australian businesses receiving export orders from customers based there. In the past six years, the portion of exporters doing business in North America has fluctuated year-to-year, but has risen 10 per cent overall.

Growth in export orders from the UK has steadied since 2016, registering 35 per cent in 2019. Trade with markets in Asia has shown signs of softening, as China (32 per cent), Indonesia (20 per cent) and South Korea (13 per cent) all fell for Australian exporters.

This year’s figures signal a change in tactics for export businesses, with the number of target markets dropping from three in 2018 to two in 2019.

This year’s figures signal a change in tactics for export businesses, with the number of target markets dropping from three in 2018 to two in 2019.

Tim Harcourt, host of the Airport Economist commented: “This year’s results show a greater number of small to medium-sized businesses entering the export market. For businesses new to exporting we typically see a trend where they concentrate their expansion in markets with familiar consumer buying preferences, cultures and languages. For Australian export businesses, these markets are likely to be other Western nations, such as New Zealand, the US or Canada.”

E-commerce

Sustaining return on investment, on-line channels proved a fruitful avenue for generating orders or enquiries for more than three in four Australian exporters this year.

Additionally, results pair with strategies engaged to drive on-line orders from overseas customers.

This year, export businesses have turned their focus to improving web site design (36 per cent, up nine per cent on 2018) and introducing more competitive promotions and discounts (20 per cent, up six per cent on 2018). Offering free or discounted delivery (20 per cent), improving payment functionality (17 per cent), and creating mobile-optimised (17 per cent) and localised web sites (15 per cent) all recorded increased uptake across the board.

Among the business classifications, Small Office/Home Office businesses with between one and four employees recorded the strongest participation in on-line marketing spend (42 per cent), free or discounted delivery (30 per cent) and more competitive promotions and discounts (28 per cent).

Small businesses (42 per cent) topped those improving the design of their web sites.

Gary Edstein, ceo and senior vice president for DHL Express Oceania said: “Although this year’s level of exporter confidence marks a decline on last

year’s record peak of 75 per cent – the highest level recorded since the study began in 2003 – Australian exporter confidence retains its headway at 69 per cent and marks a fifth consecutive year above the long-term average.” Businesses exporting mainly consumer goods registered the highest confidence level at 75 per cent, while agriculture (71 per cent) and services (70 per cent) followed close behind.

Confidence

Mining sector confidence experienced an upturn, with confidence growing to 65 from 50 per cent in 2018.

Meanwhile, the outlook for exporters in the manufacturing sector dropped nine per cent to sit at 63 per cent this year.

Small Office/Home Office-sized businesses were most confident (73 per cent), along with Small Businesses (71 per cent).

Continuing the trend of previous years, larger and more experienced exporters were the least confident – 52 per cent of Large Businesses and 57 per cent of businesses exporting for more than 20 years recorded the lowest levels of assurance in global exports.

“Interestingly, this year we have observed declines in the number of exporters prioritising on-line marketing spend (down three per cent) and improving fulfilment and delivery (down seven per cent).

“Interestingly, this year we have observed declines in the number of exporters prioritising on-line marketing spend (down three per cent) and improving fulfilment and delivery (down seven per cent).

“This could indicate a trend where exporters are strategically focusing on specific areas of their business and on-line presence. Once measured improvements in these areas have been achieved, in the spirit of continuous improvement, exporters then move on to the next area of development in their business,” said Edstein.

E-commerce

Furthermore, exporter investment in e-commerce echoes trends on the personnel front. In the next 12 months, close to two thirds (65 per cent) of Australian export businesses have plans to increase wages for current employees, and half (50 per cent) are signalling moves to create new jobs to support further business growth. Among the most confident of exporters these figures register stronger, with 72 per cent to increase wages and 63 per cent to create new jobs in the coming year.

“Plans to provide employees with wage increases and the intention to create more jobs is a strong indicator of the long term outlook of the Australian exporting sector in the midst of a period of national slowdown in regards to wage growth,” said Harcourt.

Exporting

Additionally, overall declines in targeted export markets parallel exporter sentiment surrounding the US-China trade disputes – the number of exporters predicting the projected tariffs will impact business has more than doubled in the past 12 months to 45 per cent (up from 21 per cent in 2018).

Challenge

On a region-to-region basis, tariffs exist as the most common challenge faced by exporters in the Americas (30 per cent), Europe, the Middle East and Africa (28 per cent), and South East/South Asia and the Pacific (26 per cent). Furthermore, Australian exporters cite exchange rates as a constant challenge – 30 per cent of them are experiencing impacts in the Americas and 27 per cent in North East Asia.

Encouragingly, more Australian businesses are reporting no challenges this year when exporting to the regions of North East Asia (23 per cent, up from nine per cent in 2018) and Europe, the Middle East and Africa (21 per cent, up from 12 per cent in 2018).

Issues with transport and logistics have also improved across the globe for exporters – South East/South Asia and the Pacific have seen an improvement of six per cent on the previous year, while Europe, the Middle East and Africa (five per cent), and North East Asia (four per cent) all displayed increasing levels of ease.

"Given the lingering uncertainty over trade tensions, geopolitical issues and the lack of agreement on how to deal with climate change, the drop in confidence in economic growth is not surprising - even if the scale of the change in mood is," said Bob Moritz, chairman of the PwC Network. "These challenges facing the global economy are not new - however the scale of them and the speed at which some of them are escalating is new, and leaders need to find answers.

"Given the lingering uncertainty over trade tensions, geopolitical issues and the lack of agreement on how to deal with climate change, the drop in confidence in economic growth is not surprising - even if the scale of the change in mood is," said Bob Moritz, chairman of the PwC Network. "These challenges facing the global economy are not new - however the scale of them and the speed at which some of them are escalating is new, and leaders need to find answers.  and thus give a distorted picture of how the industry is performing.

and thus give a distorted picture of how the industry is performing. • The EU and the UK will negotiate a new economic and security relationship, (including a new agreement on trade, whether some form of FTA or otherwise) based on the concepts contained in the ‘Polit ical Declaration on the EU-UK future relationship’.

• The EU and the UK will negotiate a new economic and security relationship, (including a new agreement on trade, whether some form of FTA or otherwise) based on the concepts contained in the ‘Polit ical Declaration on the EU-UK future relationship’. Australia’s trade with the EU and UK. Our exporters will also need to be careful of new regulations and procedures to be introduced at the UK border along with new standards and exposure to the UK’s new ‘dumping regime’.

Australia’s trade with the EU and UK. Our exporters will also need to be careful of new regulations and procedures to be introduced at the UK border along with new standards and exposure to the UK’s new ‘dumping regime’. The world’s biggest online retailer, Amazon started making its own deliveries after UPS and FedEx hit problems handling Christmas volumes in 2013. Roll forward six years and Amazon - now with its own airline division in the USA - delivered about half of its own global orders in 2019.

The world’s biggest online retailer, Amazon started making its own deliveries after UPS and FedEx hit problems handling Christmas volumes in 2013. Roll forward six years and Amazon - now with its own airline division in the USA - delivered about half of its own global orders in 2019. Gregoire Lebigot, president and ceo at Vallair, foresees a growing demand.

Gregoire Lebigot, president and ceo at Vallair, foresees a growing demand.  This year’s figures signal a change in tactics for export businesses, with the number of target markets dropping from three in 2018 to two in 2019.

This year’s figures signal a change in tactics for export businesses, with the number of target markets dropping from three in 2018 to two in 2019.  “Interestingly, this year we have observed declines in the number of exporters prioritising on-line marketing spend (down three per cent) and improving fulfilment and delivery (down seven per cent).

“Interestingly, this year we have observed declines in the number of exporters prioritising on-line marketing spend (down three per cent) and improving fulfilment and delivery (down seven per cent).