-

News Feed

-

Tuesday, 20 February 2018

AIMING to make Australia one of the world’s ‘top 10’ defence exporters within the next decade, the Government has launched a Defence Export Strategy that sets out a framework designed to achieve its goal.

Australia’s defence sector is already known for its innovation and ‘can do’ approach, with an increasing number of sector participants winning international contracts. Not surprisingly, overseas ‘giants’ increasingly are interested in investing in part-ownership or other forms of collaboration.

The sector uses air freight systems extensively, both inbound and out. The new export strategy could significantly boost this traffic in the target decade and beyond.

The sector uses air freight systems extensively, both inbound and out. The new export strategy could significantly boost this traffic in the target decade and beyond.

Indicative of the importance placed on the strategy, its publication was launched jointly by prime minister Malcolm Turnbull, Defence ministers Christopher Pyne and Marise Payne, and Trade minister Steve Ciobo.

The strategy features several new initiatives and investments, including a single-focus Australian Defence Export Office which will work alongside Austrade and the existing Centre for Defence Industry Capability to co-ordinate whole-of-government initiatives.

A defence export advocate will be appointed to talk up the industry at home and globally, working with both private stakeholders and government agencies.

Efic, the country’s export credit agency, will administer a A$3.8 billion facility to “provide confidence to the Australian defence industry to identify and pursue new export opportunities knowing Efic’s support is available when there is a market gap for defence finance”.

All this will be backed by A$20 million annually in direct funding, including further support for the existing global supply chain program - which is to air cargo’s benefit.

Grants will be available to help small and medium enterprises compete internationally against bigger players.

The Defence Export Strategy can be downloaded at: www.defence.gov.au/exportstrategy

-

News Feed

-

Tuesday, 20 February 2018

INDIA’s economy holds the brightest growth prospects of the world’s seven largest economies, according to results from the Global Trade Barometer (GTB) from logistics company DHL.

GTB analytics assigned India the highest growth indices of the seven countries assessed, due to strong and sustained increases in both air and ocean freight in and out of the country.

The country’s trade in machinery and high-tech goods continues to underpin its growth, while increased imports of industrial raw materials point to an extended period of trade development for the nation.

“More than any of the world’s largest economies, India’s major industries have displayed levels of resilience and growth that will buoy business confidence in the short-to-medium term,” said George Lawson, managing director, DHL Global Forwarding India.

“More than any of the world’s largest economies, India’s major industries have displayed levels of resilience and growth that will buoy business confidence in the short-to-medium term,” said George Lawson, managing director, DHL Global Forwarding India.

“India’s economy has built up terrific momentum in recent times: Since 2008, its GDP has risen every single year to US$2.44 trillion last year, more than double the levels of a decade ago. As the country continues to invest heavily in infrastructure, we expect it to continue its upward trajectory for the foreseeable future.”

According to the GTB, businesses in India can expect ocean trade to further improve on already-high levels, largely thanks to demand for commodities and industrial materials from overseas.

Air freight demand is projected to remain stable at its current highs, sustained by growth in machinery and technology imports. Both India’s air and ocean freight forecasts proved stronger than those of any other country in the GTB -- in large part due to every major sector making a positive contribution to the country’s trade.

Developed jointly by DHL and Accenture, the GTB provides a quarterly outlook on future trade, taking into consideration the import and export data of seven large economies: China, South Korea, Germany, India, Japan, the United Kingdom and the United States. Together, these countries account for 75 per cent of world trade, making their aggregated data an effective bellwether for near-term predictions on global trade. The GTB, which assesses commodities that serve as the basis for further industrial production, predicts that global trade will continue to grow in the next three months, despite slight losses in momentum.

-

News Feed

-

Tuesday, 20 February 2018

RETAILERS and etailers that ‘react fastest to the shift in consumer behaviour and meet customers’ expectations for speed of delivery and returns’ earn the highest levels of customer loyalty and revenue growth, according to commercial director of Seko Omni-Channel Logistics Justin Irvine.

RETAILERS and etailers that ‘react fastest to the shift in consumer behaviour and meet customers’ expectations for speed of delivery and returns’ earn the highest levels of customer loyalty and revenue growth, according to commercial director of Seko Omni-Channel Logistics Justin Irvine.

Irvine said: “The world of e-commerce is shifting in the way people buy goods and their expectations of how quickly they want their goods. This is not as scary or daunting as you might think, nor as costly. Express delivery to Asia Pacific, for example, is now cheaper than express delivery to most of Europe.”

He added: “UK and European retailers and etailer giants have led the way in on-line cross-border trade and we are working with mid-size companies that have been quick to drive their own initiatives and value to global customers. This is particularly true of UK brands, which are some of the most sought-after in the international consumer market. UK retailers selling on line are already seeing the financial benefits of selling outside of the UK/EU and they represent great business models for equally ambitious companies.”

Currently, the UK is the third largest e-commerce market in the world, with 46 per cent of UK SMEs exporting and receiving revenue from overseas, and reporting a revenue growth rate of 1.8 per cent versus just 1.2 per cent for domestic-only operations.

However, nearly all cross-border movements take place via airfreight and the lack of available aircraft capacity, combined with demand outstripping supply in a buoyant market, means standard offerings will become more expensive, and the ability to provide a reasonable transit time at a reasonable cost will become more important in the short-to-medium term, Irvine believes.

“Speed and service drive growth. It is already clear that consumers shop more and have higher cart spends with companies that provide consistently higher service levels. And, quite often they are willing to pay to receive a better service once they have confidence in a retailer/etailer’s ability to deliver. UK retailers can now deliver to Asia and Australasia – collectively the largest eCommerce growth market in the world – in 2-3 days for under GBP10.00 (A$17.70). Companies that deploy these increased service levels can expect to see their businesses grow 1.6 times faster.”

Claire Muir, Seko’s commercial director – Fulfilment and Contract Logistics added: “Many companies’ fulfilment strategies also need a fast, robust and cost-efficient returns process, because this is now a fundamental factor in consumer buying habits.

“Research shows 67 per cent of shoppers check the returns page before making a purchase and 92 per cent will buy something again if returns are easy. Speed of returns and refunding customers has become a real focus for businesses as it promotes strong loyalty and repeat buyers. With integrated returns providers now available to work with, companies can now refund customers from parcel drop-off/collection in 3-5 calendar days. This is the new norm – and it is driving the growth in online sales.”

Seko offers companies looking to grow in the international market four key recommendations:

Seko offers companies looking to grow in the international market four key recommendations:

- Define your customer engagement strategy based on what the local market expectation is, and exceed it.

- Establish a base of proven suppliers that can demonstrate a track record.

- Work with multiple partners. No single carrier is likely to be able to service your needs on all lanes for all service levels.

- Ensure you immediately enable in-country processing in your top countries.

- Wherever possible, ensure Express/Priority services are your standard offering, or at least free past a given dollar value.

-

News Feed

-

Tuesday, 20 February 2018

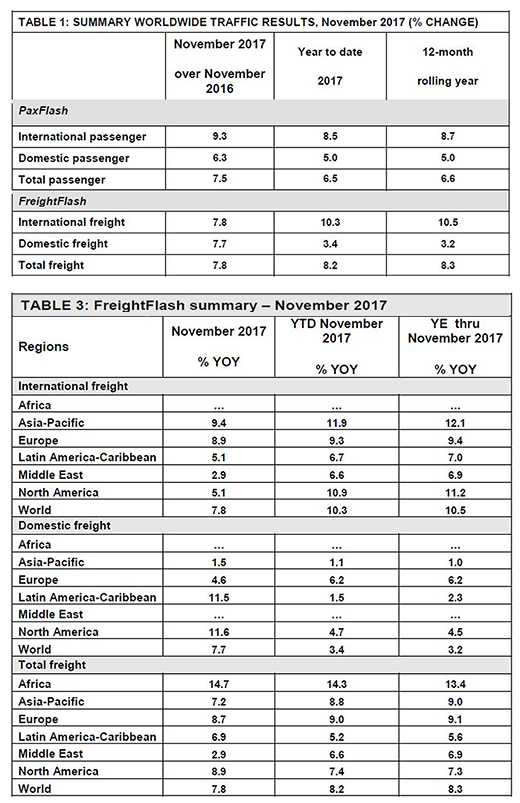

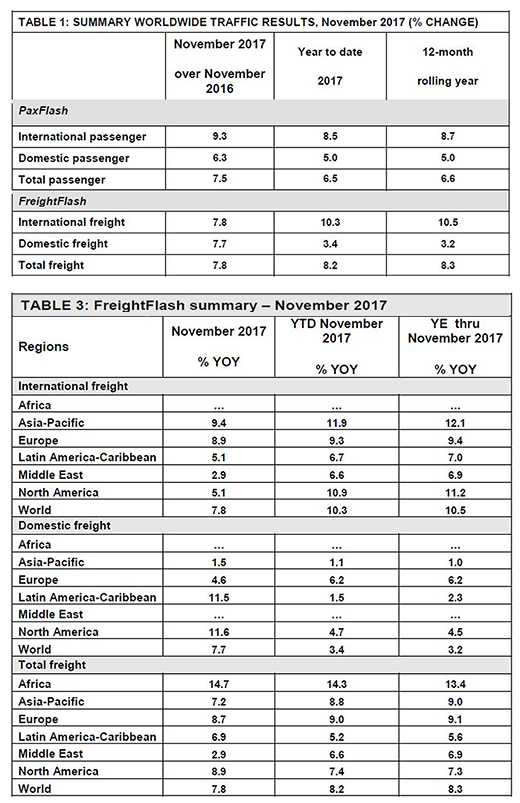

AFTER posting more moderate growth during October, November’s freight volumes rose substantially, reaching +7.8 per cent on a year-over-year basis.

Standing at +8.2 per cent on a ‘year-to-date’ (November) basis and with only one month left to tally in 2017, global freight figures are bound to show record growth for 2017.

The strong growth in volumes in November was thanks to global trade, according to the latest report from Airports Council International (ACI) World.

Africa, North America and Europe once again topped growth figures for total freight, reaching +14.7, +8.9 and +8.7 per cent respectively.

Asia-Pacific (+7.2 per cent), Latin America-Caribbean (+6.9 per cent) and the Middle East (+2.9 per cent) followed, the latter starting to regain speed after slowing down to +1.3 per cent in October. On a year-to-date (November) basis, all regions were posting growth of more than five per cent.

International freight drove most of the increases, reaching +7.8 per cent after slowing down to +4.4 per cent over the three months prior to November. Airports in the Asia-Pacific region led volumes handled for export and overall growth.

Double-digit growth in total freight volumes will be achieved for airports as a whole in the region for 2017.

At the local level, large markets have been contributing to this success, with India (+17.9 per cent), China (+16.7 per cent), Japan (+12.8 per cent) and Thailand (+11.5 per cent) leading on a year-to-date basis, and Hong Kong (+9.5 per cent) following close behind (for international trade volumes). The United States, the largest domestic freight market in the world, saw significant strides in volumes, increasing by +5.1 per cent on a year-over-year basis. In Europe, growth was boosted by strong numbers in Spain (+15.6 per cent), the United Kingdom (+13.2 per cent) and Turkey (+11.3 per cent). All three of these countries had year-to-date numbers reaching double-digit growth.

Passenger traffic

Meanwhile, global passenger traffic was up 7.5 per cent in November on a year-over-year basis. This was above the already-robust 6.5 per cent year-over-year from January to November.

Asia-Pacific (+10.6 per cent), Africa (+10.5 per cent) and Europe (+8.1 per cent) all posted particularly high growth in November. International traffic was a key driver for these increases, especially for European and Asia-Pacific markets. Strong overall business and consumer confidence continued to boost carriers offering low cost options. Africa continued to experience a strong recovery, following the recession that affected the continent’s largest economies Nigeria and South Africa.

On the other hand, Asia-Pacific’s domestic traffic rose significantly during the month, reaching +9.3 per cent. The figure remained below the region’s international traffic growth, however, which stood at +12.9 per cent.

Total passenger traffic in North America, Latin America-Caribbean and the Middle East grew at a more moderate pace, reaching +4.8, +3.8 and +3.5 per cent respectively.

Both North America and Latin America-Caribbean were negatively affected by weather events during September, the effects of which are progressively receding. The Middle East’s growth in passenger traffic was still disrupted by tensions between major players in the region, with internal strife disrupting Yemen and the partial blockade against Qatar still in place.

At the local level, Asia-Pacific’s largest markets enjoyed significant growth in November, with Indonesia’s passenger traffic rising at +17.9 per cent for its major commercial airports, Thailand at +15.9 per cent, India at +14 per cent and China at +12.5 per cent. On a year-to-date basis, India and Indonesia are set to post double-digit growth for 2017.

Latin America-Caribbean international passenger traffic reached +6.5 per cent, close to its year to date figures of +6.6 per cent, after suffering a decline in October. This recovery could bring the region’s growth rate to more than seven per cent by end year.

Current global growth by November’s end was 6.5 per cent, in line with 2016 numbers. Unless December numbers bring surprises, this year should bring another period of high growth for the airport industry.

-

News Feed

-

Tuesday, 20 February 2018

BRIAN Lovell has been chief executive of the Australian Federation of International Forwarders (AFIF) and its predecessor AFAFF for 23 years.

BRIAN Lovell has been chief executive of the Australian Federation of International Forwarders (AFIF) and its predecessor AFAFF for 23 years.

Lovell says while his job title is the same, his role has changed significantly because global events have altered the industry which is now unrecognisable from that when he began in the role.

While AFIF membership remains strong and the freight market is showing good growth, Lovell sees future issues, with the forwarder industry under threat from overseas outsourcing and technology replacing traditional roles, resulting in a loss of industry knowledge and experience in the sector. Lovell spoke to AirCargo Asia-Pacific about his priorities.

International airfreight markets were strong towards the end of 2017. What is your expectation for 2018-19?

Brian Lovell: We are familiar with IATA airfreight figures that indicate the industry is performing very well across all global markets including Asia-Pacific. However, time will tell if the momentum will continue. There is no indication of significant growth in our market in the first part of the calendar year. But the industry workplace remains positive and with new trade related agreements, there is always the opportunity for growth in this region.

What is AFIF’s position on the renamed Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), the new deal announced on 24 January (without the United States). Is it a positive move for members?

The full details of the CPTPP are yet to be announced but my personal understanding of the deal is that it offers improved trading conditions with our major trading partners - and that should be a positive for Australia. Obviously I reserve judgement until all the details are known but my initial reaction is positive.

Technology has been a boon for the freight industry, but it is not without problems. The Department of Home Affairs is having a lot of problems with its ICS. Has this affected your members’ productivity?

The ICS has a chequered record, commencing with a disastrous start in 2005 which is well documented. Now it’s already in effect a ‘legacy’ system which is still operating. Therefore any changes required require both financial and manpower resources by the department.

We are continually frustrated with the system and its inability to be flexible in today’s market and as far as I know, there are no plans for a major overhaul. The ICS fixes are a patchwork applied on an ‘as needs’ basis. The next system needs to be a completely new model embracing the latest technology.

What is AFIF’s view of Australia’s new powerful mega ministry Home Affairs?

We believe the creation of the Home Affairs department needed to happen because there are so many government agencies with information that needs to be shared among them.

This required a major integration of the departments and will be far more extensive than that which we saw with the integration of the Immigration and Border Protection departments.

At this stage with Home Affairs we are dealing with mainly the same people in the same positions, however we envisage this will change in due course as integration proceeds.

Does AFIF have a good working relationship with the new organisation?

AFIF has good working relationships with a number of government agencies. When they are combined under one roof, so to speak, it will be interesting to see if those working relations continue to be as strong in the new regime.

Obviously we hope so, because we have worked long and hard to create good business relationships.

The Customs Brokers and Forwarders Council of Australia (CBFCA) has again suggested closer ties - even a possible merger - with AFIF to create a stronger voice and reduce operating costs. Is this something AFIF supports? Have any studies been done into potential savings if a merger were to go ahead?

Recent attempts to merge the two organisations failed for a number of reasons. However, it’s clear we communicate well and both already sit on a number of industry committees. We have a very good working relationship.

The prospect of a merger at some time in the future is possible, provided it is a good deal for our members and the wider industry in general. Opportunities (for efficiencies) will never be disregarded.

What is next in AFIF’s education and training programs?

Training and education in the freight industry has to move with the times. We monitor and examine each of our various courses to make sure they incorporate the latest industry technology and innovation for industry inductees as well as seniors seeking refresher training.

We have some areas of concern with some areas of business that are not covered by education and training that relate to the future of our industry. Our chief concern is that a lot of the junior positions are being outsourced not just to other countries but now with technology they are becoming centralised for processing.

Business is concerned there will be a resulting lack of expertise and working knowledge among those coming through to fill higher level management positions.

AFIF has taken the lead in researching to identify the future problems and seeking solutions to assist our membership and industry with future training and recruitment sources.

Is AFIF using the cloud-based technology that apparently is popular with millennials?

The AFIF ‘Crucial Skills’ project will identify the needs of our future workforce both in terms of education training and involvement. The proposed future industry induction training would involve cloud-based solutions but there will still be a need for a variety of training service applications both internet and face to face. Whatever works best for the profession.

What issues is AFIF focused on in 2018?

Security is a major focus in line with the government’s assessment of increased risk. AFIF is moving to fulfil its members’ requirements.

Globalisation and regionalisation have equal footing these days and we need to shift our emphasis in line with how they affect our membership’s operations in these changing times.

For example, Brexit, China’s Belt and Road initiative and the changed global interface policies from the USA have created new issues with a direct impact on global trade.

These events require monitoring and analysis to ascertain their impact on Australia’s trade and the forwarders who are responsible for a significant majority of freight movements.

In 2017 we saw big changes to international air cargo security requirements, particularly for US-bound cargo. Are more changes planned?

Yes, changes in security are likely to be constant and based on the national risk assessment. Implementation of the changes that took place in July 2017 was relatively smooth, but the next phase will require an expansion of those new rules to a wider community. At this stage we do not have clear details of the changes (the government has not released any). When they are known, AFIF will be involved in discussions with the relative government agencies and will provide advice on behalf of its members prior to implementation.

AFIF will be holding its 2018 conference in Sydney. How is the event shaping up?

We have changed the format for the 2018 event, which returns to Sydney after a long absence. In the past we elected to hold the annual event at a resort-type venue, but the Sydney show will be more in keeping with members’ desire to streamline the event, bearing in mind time constraints for many.

This year the conference will be held on one full day at the Novotel Brighton Beach, Sydney on 25 May but it will offer a Welcome Reception the night before the conference and will close with a Gala Dinner and have some fun functions and entertainment along the way.

The deputy minister for the Department of Home Affairs, Alex Hawke, has been invited to deliver the keynote presentation.

-

News Feed

-

Tuesday, 20 February 2018

The Trans-Pacific Partnership (TPP) was an ambitious 12 nation free trade agreement (FTA) that was agreed by participants some time ago but never formally implemented, even though its entry into force had been approved by New Zealand and Australia.

The TPP has subsequently evolved into a new 11 nation version now known as ‘TPP11’ or, more formally, as the Comprehensive Progressive Trans Pacific Partnership (CPTPP), which appeared to have been approved by the 11 member nations at a meeting in Japan late in January 2018.

Recent history - clinching victory from the jaws of defeat

The evolution of the TPP into the CPTPP has not been without controversy, surviving two near-death experiences. First, when the US withdrew from the TPP following the Trump administration taking office. Second, when Canada stalled on an agreement to the deal at the APEC Ministers meeting in November 2017, when the deal seemed to have been completed. On both occasions there were a number of reports of the death of the TPP, but subsequent events seem to have proved that such reports were exaggerated and that the CPTPP would proceed with the remaining 11 nations - with signing reported to take place on 8 March and (hopefully) implementation later this year or early in 2019.

So, more accurately the CPTPP is not ‘back from the dead’ but instead it represents an example of flexibility in negotiations and willingness to preserve the benefits of a deal in the face of adversity.

Transparency on the terms of the CPTPP

Transparency on the terms of the CPTPP

Some details of the CPTPP are found in the DFAT release and Ministerial media releases.

There has been some criticism around alleged secrecy on the terms of the CPTPP. While the text of the CPTPP has yet to be released, its details can be constructed based around the original TPP (in the public domain), the removal of the US and details of 22 ‘suspensions’ to the TPP agreed at the APEC meeting.

Based on this available material, there is already some significant transparency around the terms of the deal, which will become total when the final text is released after signing next month.

Highlights for industry

Some of the highlights for those in industry moving goods appear to be as follows:

• It will improve our existing FTAs with countries who are also parties to the CPTPP.

• It will constitute new trade deals for Australia with Canada and Mexico.

• It will eliminate more than 98 per cent of tariffs in the trade zone.

• Tariffs will be eliminated on trade in sheep, meat, cotton, wool, seafood, horticulture, wine and industrial products.

• New quotas for wheat, rice and sugar to Japan, Canada and Mexico will be granted.

• New reductions in Japan’s tariffs on beef (Australian exports worth A$2 billion in 2016-17).

• New access for dairy products into Japan, Canada and Mexico, including the elimination of a range of cheese tariffs into Japan covering over A$100 million of trade.

• Tariff reductions and new access for our cereals and grains exporters into Japan, including, for the first time in 20 years, new access for rice products into Japan.

• Providers of transport and logistics services will benefit from simpler Customs procedures and freight providers in Malaysia and Vietnam will gain more effective trade and investment protections for the first time, guaranteeing any future market reforms also flow through to Australian providers.

• The provisions for claims of origin are reasonably consistent with previous practice with the benefit that there is no mandatory use of certificates of origin issued by ‘approved authorities’. - Hopefully this will allow additional complexity compared to ChAFTA.

There also are other significant gains in the areas of services and investment as well as the benefits which arise from agreement on trade rules as between nations (even when such gains may not be able to be readily quantified).

Measuring the benefits -— possible and practical?

Further doubts have been expressed as to the quantum of the benefits to be delivered by the CPTPP and there have been calls for the deal to be reviewed by the Productivity Commission before coming into force. However, those calls do not seem to take into account the following:

• The TPP was previously reviewed and endorsed by the Australian Parliament’s Joint Standing Committee on Treaties (JSCOT).

• The respected Peterson Institute had already modelled the benefits of the CPTPP in a study which confirmed substantial benefits even without the US.

• Business welcomed the deal - even with its limitations.

• The ECA issued a media release which identified some restrictions on reviews by the Productivity Commission which do not take into account a number of broader issues which cannot be reduced to figures at this stage.

• The current scope of the CPTPP is only the beginning. There are other countries such as Korea which have expressed an interest in joining the CPTPP - there is even commentary that the US is re-considering its position. Further membership can only increase the benefits and the deal sets the basis for further gains.

• The terms of the CPTPP will be subject to review by JSCOT, which allows a lot of parties the opportunity to make commentary on the CPTPP and its process.

A broader pivot to the ‘other’ Americas?

Even with the US dropping out of the CPTPP there still remains a discernible move in focus to the Americas. Not only does the CPTPP effectively include a new FTA with Mexico, but we have recently concluded a deal with Peru, one of the fastest-growing economies in South America. In conjunction with New Zealand we are also progressing negotiations with the ‘Pacific Alliance’ countries which include Mexico and Peru as well as Colombia and Chile (with whom we already have an FTA). Given our FTAs with three of these countries the prospects look good.

All of these developments improve access into relatively new markets and represent an interesting comparison to regional delays with the Regional Comprehensive Economic Partnership, in our deals with India and Indonesia and the recent imposition of increased import duties by India. Our deals with North Asia have delivered good results - and given my knowledge of some of the negotiators of the CPTPP I remain confident that it has been completed with national best interests in mind.

The CPTPP — part of needed positive outcomes

I remain positive around the CPTPP - as I was for the TPP. We should accept that in a ‘second best’ world no one deal is perfect. At the same time that there are negatives in the global trade agenda, the CPTPP and other developments such as described above represent a useful counterbalance to increasing protectionism and demonstrate that the world can still move forward without the US or other major trading partners that appear either to be taking shelter in protectionism or to be limited by political uncertainty.

Stay tuned for developments including more detail on adoption and implementation of the CPTPP — and, of course if pain persists contact your friendly Customs and trade lawyer.

-

News Feed

-

Tuesday, 20 February 2018

Asia’s digital logistics provider Openport is to join industry leaders including UPS, FedEx, Schneider National and SAP in the Blockchain in Transport Alliance (BiTA).

BiTA is the forum for the development of blockchain standards and education for the freight industry.

OpenPort Founder and ceo Max Ward said: “In developing regions, where the financial resources allocated for the movement of goods can be as much as 25 per cent of a nation’s annual GDP, paper-based proof of delivery systems delay invoicing, impact working capital and open the door to disputes.

OpenPort Founder and ceo Max Ward said: “In developing regions, where the financial resources allocated for the movement of goods can be as much as 25 per cent of a nation’s annual GDP, paper-based proof of delivery systems delay invoicing, impact working capital and open the door to disputes.

“For emerging markets experiencing economic growth, freight volumes are outstripping the capacity for efficient and cost-effective scaling, raising logistics costs. New technologies such as blockchain proof of delivery and tokenised micro-rewards for supply chain participants provide a clear solution,” added Ward.

Delivering real-time status updates from tender through to the delivery stage, OpenPort facilitates lower costs, increased control, and improved cash flow.

Already supporting many of the world’s largest shippers, including engagements with seven of the 10 largest multinational FMCGs, OpenPort claims to be Asia’s only multinational digital logistics provider. At present, OpenPort is facilitating direct, transparent relationships among parties in the supply chains of China, Hong Kong, India, Indonesia, Pakistan, and the Philippines.

Facilitated by the OpenPort OpenTM (transport management) software and Driver App, an application that allows truck drivers to use their phones to capture electronic proof of delivery (ePOD) and send shipment data during transport, OpenPort’s digital ePOD ecosystem was established in early 2017.

OpenPort is now utilising blockchain technology to create an immutable ePOD with an indisputable record of the freight’s history and plans to use micro-rewards to incentivise data sharing via its OPN token.

“OpenPort’s technology framework shows great promise and the Asian Pacific rim where the organisation is focused is the world’s factory. We are excited to partner and facilitate a forum for commercial success,” said Craig Fuller, managing director of BiTA.

Founded in August 2017 and aiming to lead, develop, and embrace a common framework and establish standards from which industry participants can build revolutionary applications, BiTA has seen more than 250 companies join within the past six months. The world’s largest commercial blockchain alliance, BiTA now represents hundreds of global freight transportation companies.

In addition to joining the Alliance, OpenPort will be sponsoring Transparency18, a two-day event covering the digitisation of trucking, 3PLs, modern supply chains, blockchain, IoT and autonomous and electric vehicles. Attracting key industry players across the globe, including representatives of the largest Fortune 1000 companies, innovators, entrepreneurs, investors, startups and forward-leaning market participants, the event is scheduled for May 22-23, 2018 in Atlanta, Georgia.

“As we strive to revolutionise the trucking industry in emerging markets throughout Asia and ultimately the world, we are honoured to join such an esteemed Alliance. Blockchain offers a truly revolutionary solution to the financial and ecological detriments that have arisen in traditional transport systems, and we are very excited to collaborate with companies that share our ambition of welcoming a new era of efficiency and transparency for the transportation industry as a whole,” concluded Ward.

For more information about OpenPort visit: https://openport.com/

-

News Feed

-

Monday, 18 December 2017

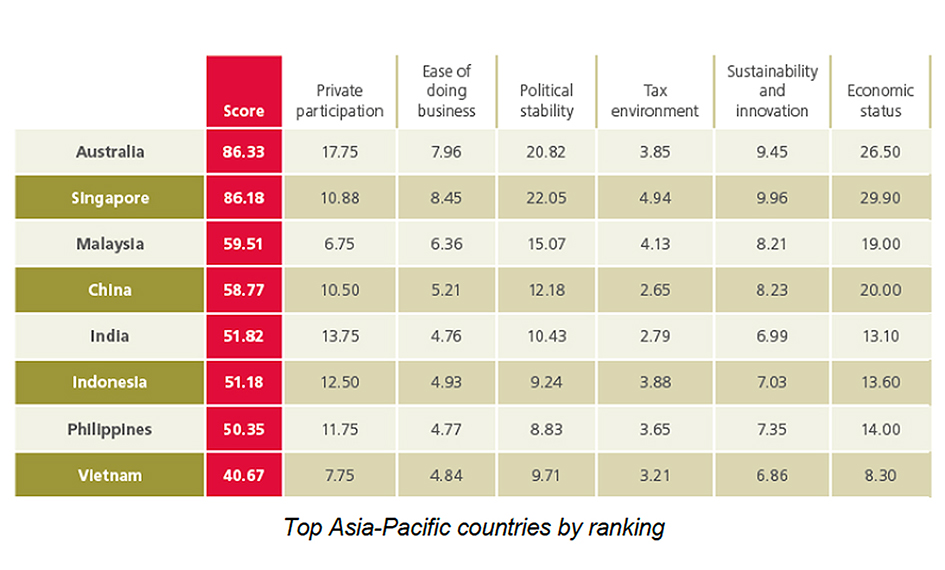

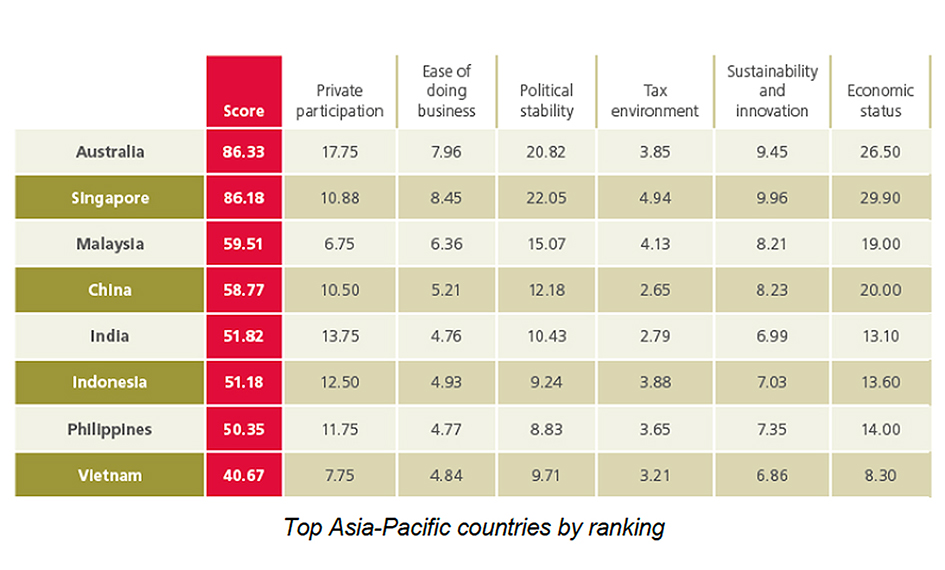

AUSTRALIA, Singapore and China are driving increased interest in infrastructure investment in the Asia-Pacific region, according to international law firm CMS’ Infrastructure Index: A New Direction, which ranks 40 jurisdictions in order of infrastructure investment attractiveness according to six key criteria.

Four of the top 20 spots for investment attractiveness were secured by Asia-Pacific countries, with robust economic growth across the region, ambitious renewables plans and the world’s largest infrastructure project - China’s Belt and Road - set to re-shape the continent’s landscape over the next decade.

Netherlands claims top spot

The Netherlands claimed top spot overall after posting its highest GDP growth since 2007, expected to reach 3.3 per cent for the 2017 year.

The country’s success was in part down to its transparent and efficient procurement process, and its healthy multi-billion-euro pipeline in road and water Public-Private-Partnerships (PPPs). Other countries in the top five were Canada, Germany, UK and Australia.

Kristy Duane, CMS partner and co-head of Infrastructure and Project Finance in the UK said: “From China’s Belt and Road to the UK’s Brexit bump in the road, politics and policy remain central to shaping infrastructure investment flows globally.

Kristy Duane, CMS partner and co-head of Infrastructure and Project Finance in the UK said: “From China’s Belt and Road to the UK’s Brexit bump in the road, politics and policy remain central to shaping infrastructure investment flows globally.

“If governments are to attract the private capital available, they should look to countries like the Netherlands and Canada for inspiration where transparency and a clear strategic vision for infrastructure shapes the agenda.

“The CMS Infrastructure Index charts shifts in the attractiveness of 40 countries across the globe and also highlights changes occurring in the infrastructure asset class, bringing a new wave of innovation to a market long dependent on standardised PPPs for much of its deal flow. The quest for deals has already prompted the industry to explore less mature sectors such as energy storage, broadband, smart meters, student accommodation and rolling stock. It is fascinating to see which countries are leading the way.”

China

China’s Belt and Road initiative continues to deliver on the promised infrastructure boom in Asia. Given the longevity of this project, changes in the balance of infrastructure investment in the region are likely to be profound. Though ranked at 20th position in the Index, China is primed to become a global engine of investment, with close to a trillion dollars expected to flow through the initiative by its completion, while highly ranked countries such as Australia and Singapore continue to benefit from stable and prosperous economies.

Australia’s federal target of 33,000GWh generated from renewable sources by 2020 has led to vast investment in solar and wind projects, and Singapore’s multi-billion-dollar development of Changi Airport’s Terminal 5 and the Tuas shipping megaport will solidify its position as a premier transport and trade hub globally.

Further afield, opportunities in Malaysia and India are plentiful, with renewable energy set to play a central role in future projects.

Adrian Wong, partner at CMS Singapore said: “The Asia-Pacific region is home to some of the world’s fastest-growing economies and most ambitious infrastructure projects, and the spread of four countries within the Index top 20 reflects an ever-developing opportunity for investment. While key success factors like government stability and political certainty cannot be ignored, the potential impact of the Belt and Road initiative alone promises to stimulate economic growth through the continent and far beyond.”

Doctor Nicolas Wiegand, partner at CMS Hong Kong added: “The risks of adverse government interference that are typically associated with investing in the Belt and Road jurisdictions are mitigated through an extensive and ever-expanding network of Asia’s investment treaties and free trade agreements with integrated investment chapters. In addition to investment treaties, the political risk insurance industry in the Asia-Pacific region has developed sophisticated insurance policies for insuring foreign investment in volatile Asian jurisdictions. As with previous years, investor-State arbitration remains an efficient tool to protect foreign investments in Asia, with Chinese companies becoming increasingly frequent users of investor-State dispute settlement mechanism.”

Europe

European countries have bounced back after a period of stagnation. Quantitative easing, the Juncker Plan and EIB support have all contributed to accelerated levels of EU infrastructure spending in recent years, and with economies such as Czech Republic and Romania experiencing significant expansion, there is room for optimism for future investment, according to the report.

Europe as a whole has experienced an upsurge in infrastructure investment, as many politicians have used infrastructure investment as an economic stimulant. As well as the Netherlands and the UK, Germany, Norway and France all ranked highly in the study, particularly for innovation. In Germany, all dominant parties have placed their support behind PPPs, and it is expected that deal flow, particularly in large-scale transport PPPs, will stay the course.

In the UK the impact of Brexit and general political instability is already starting to have an impact on infrastructure investments, as investors struggle with a lack of certainty in the country. Those operating across the sector are clearly looking for commitment and long-term policy from government to allay fears. The report highlights in particular the lack of consensus over infrastructure mega-projects such as a third Heathrow runway.

In the Americas, Canada leads the way, while a lack of detail on Trump’s proposed US$1 trillion US infrastructure project leaves the US lagging behind in seventh position. Notably, the Canadian government is to launch the Canadian Infrastructure Bank in 2017, providing a boost to the already reliable infrastructure market.

UAE

In other regions, MENA has succeeded in looking at alternatives to combat ongoing low oil prices. UAE and Saudi Arabia both have shown a keen interest in renewables. UAE has already played a pioneering role in exploiting high levels of solar irradiation, while Saudi Arabia’s recent commitment to clean energy is hailed as a game changer for the regional pipeline.

The report also highlights potential new emerging asset classes including 4G, charging stations, car parks and technologies which already have started to revolutionise infrastructure. One example is the rise of smart roads and smart cities, thanks to the interaction of road sensors, fibre optic networks, interconnected self-driving vehicles and inductive charging roads laying the foundations for a new generation of self-charging and self-driving electric vehicles. Cities like Dubai and Singapore are already making strides to lead the next wave of digital innovation.

The sector uses air freight systems extensively, both inbound and out. The new export strategy could significantly boost this traffic in the target decade and beyond.

The sector uses air freight systems extensively, both inbound and out. The new export strategy could significantly boost this traffic in the target decade and beyond.

“More than any of the world’s largest economies, India’s major industries have displayed levels of resilience and growth that will buoy business confidence in the short-to-medium term,” said George Lawson, managing director, DHL Global Forwarding India.

“More than any of the world’s largest economies, India’s major industries have displayed levels of resilience and growth that will buoy business confidence in the short-to-medium term,” said George Lawson, managing director, DHL Global Forwarding India. RETAILERS and etailers that ‘react fastest to the shift in consumer behaviour and meet customers’ expectations for speed of delivery and returns’ earn the highest levels of customer loyalty and revenue growth, according to commercial director of Seko Omni-Channel Logistics Justin Irvine.

RETAILERS and etailers that ‘react fastest to the shift in consumer behaviour and meet customers’ expectations for speed of delivery and returns’ earn the highest levels of customer loyalty and revenue growth, according to commercial director of Seko Omni-Channel Logistics Justin Irvine. Seko offers companies looking to grow in the international market four key recommendations:

Seko offers companies looking to grow in the international market four key recommendations:

BRIAN Lovell has been chief executive of the Australian Federation of International Forwarders (AFIF) and its predecessor AFAFF for 23 years.

BRIAN Lovell has been chief executive of the Australian Federation of International Forwarders (AFIF) and its predecessor AFAFF for 23 years. Transparency on the terms of the CPTPP

Transparency on the terms of the CPTPP OpenPort Founder and ceo Max Ward said: “In developing regions, where the financial resources allocated for the movement of goods can be as much as 25 per cent of a nation’s annual GDP,

OpenPort Founder and ceo Max Ward said: “In developing regions, where the financial resources allocated for the movement of goods can be as much as 25 per cent of a nation’s annual GDP, Kristy Duane, CMS partner and co-head of Infrastructure and Project Finance in the UK said: “From China’s Belt and Road to the UK’s Brexit bump in the road, politics and policy remain central to shaping infrastructure investment flows globally.

Kristy Duane, CMS partner and co-head of Infrastructure and Project Finance in the UK said: “From China’s Belt and Road to the UK’s Brexit bump in the road, politics and policy remain central to shaping infrastructure investment flows globally.